- The EUR/USD has been trading around daily highs lately and has enjoyed a three-day winning streak.

- Reduced yields on government bonds and US dollar due to eased fears over the Coronavirus from China and mixed thoughts about the Moscow-Kyiv talks.

- Eurozone data softens despite mixed US economy, Fed worries about market filters strengthening.

Early Wednesday morning in Asia, the EUR/USD price analysis was up 0.11% on the day after rallying earlier in the week. Meanwhile, the major currency pair welcomes the drop in US Treasury yields ahead of the all-important Federal Open Market Committee (FOMC).

–Are you interested in learning more about making money with forex? Check our detailed guide-

Declining US yields

Weak inflation expectations and mixed data from the US appear to have supported the recent decline in US bond coupons. The US producer price index (PPI) did meet expectations of 10% growth, but New York State’s manufacturing index posted its biggest decline since May 2020. Data from the St. Louis Federal Reserve (FRED) showed that the breakeven inflation rate for the year declined for the second day in a row after hitting a record high.

Russia-Ukraine peace negotiations

Additionally, cautious optimism over the Ukraine-Russian peace talks and easing concerns over the Coronavirus in China are weighing on dollar safe-haven demand. US stock futures seem to be challenged by mixed comments from the presidents of Russia and Ukraine regarding the progress of peace talks and the likelihood of a positive outcome.

ECB on inflation concerns

Pablo Hernandez de Cos took on the challenge of inflation stemming from recent geopolitical play after the Eurozone industrial production data for January and the ZEW sentiment index for March disappointed him. According to the politician, the Russian invasion of Ukraine will negatively impact economic activity and increase inflationary pressure. In a similar vein, Christine Lagarde, president of the European Central Bank, said inflation is still expected to decline gradually to around 2% by 2024, as set by the central bank.

With this backdrop, S&P 500 futures fall 0.18% to 4.257, while US 10-year Treasury yields indicate a seven-day uptrend and are at 2.145%, their highest level since June 2019. As of press time, the US Dollar Index (DXY) is still falling below 99.00 from the previous day.

Fed and retail sales ahead

It is likely that EUR/USD buyers will brace for a hawkish Fed decision, as many expect 0.25%. The bulls will overcome the near hurdles only if there is any disappointment in economic forecasts or Fed Chair Jerome Powell’s speech.

The Fed’s verdict, US retail sales data for February, which are expected to fall from 3.8% to 0.4%, and the comments of ECB board member Frank Elderson will also be important. Furthermore, risk catalysts, such as Coronavirus headlines from China and news from Ukraine and Russia, are likely to drive EUR/USD near-term price movement in a way that challenges bulls.

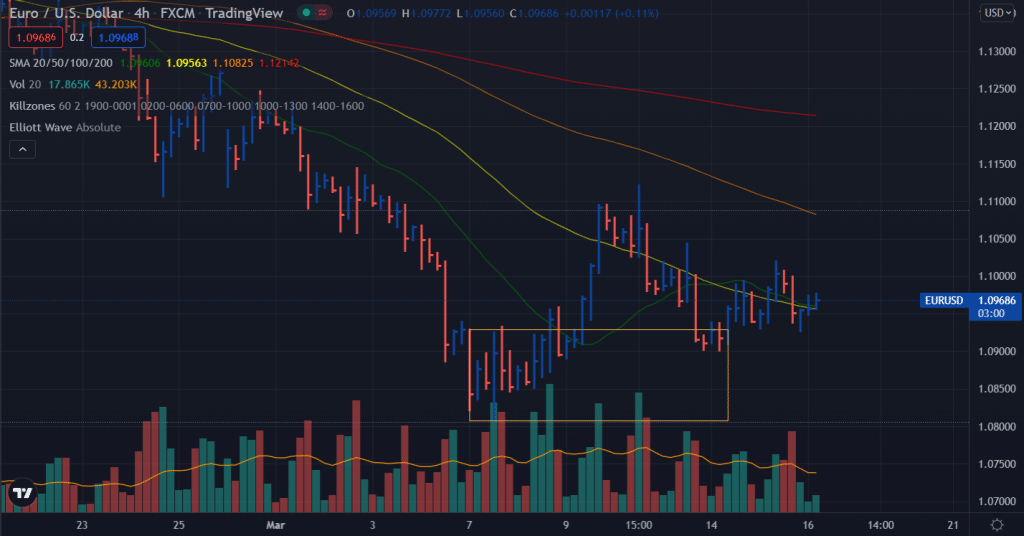

EUR/USD price technical analysis: Bulls lack follow-through

The EUR/USD price slightly gained above the 1.0950 area. The pair managed to stay above the 20-period SMA on the 4-hour chart. However, the bulls lack strength, and the immediate background contains an upthrust bar as well.

A clear breakout above the 1.1000 area will gather further traction. In that case, we anticipate the price to test 1.1050 ahead of 1.1100.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

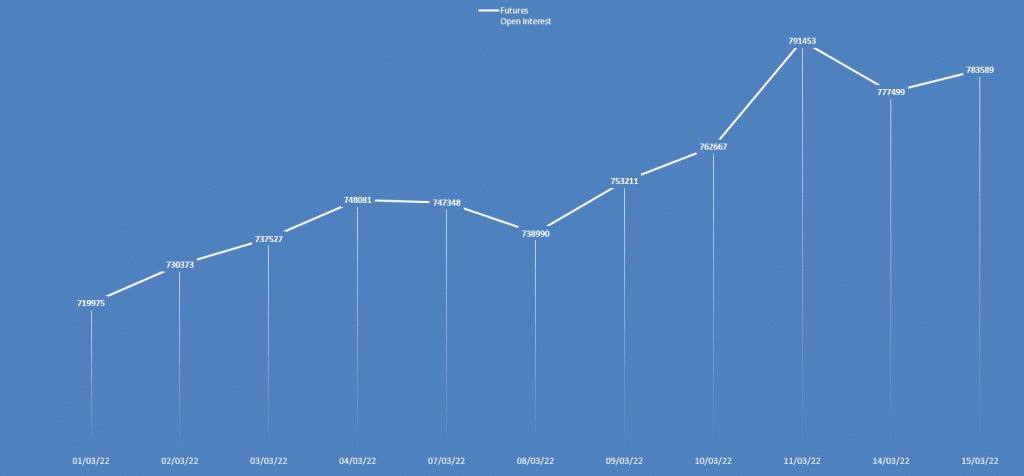

EUR/USD price analysis via daily open interest

The EUR/USD closed yesterday with a slight gain while the open interest increased too. This is a neutral to bullish situation as the price gain is very low. However, it is still a sign of further gains.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money