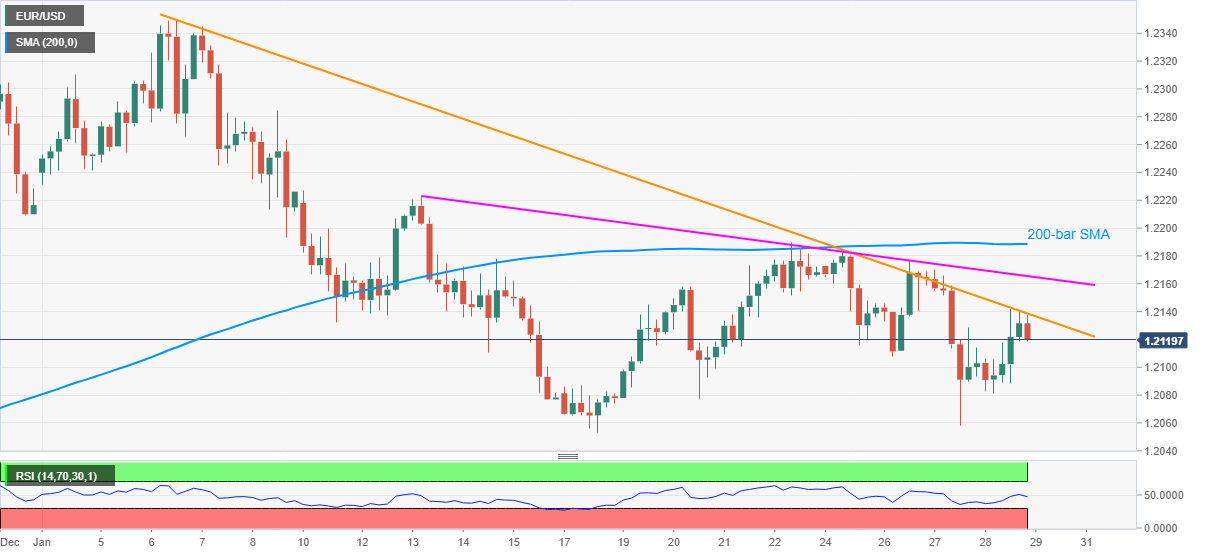

- EUR/USD eases from short-term key resistance line despite keeping the 1.2118-42 trading range.

- Normal RSI, repeated failures to cross immediate hurdle favor sellers’ return.

- A descending trend line from January 13, 200-bar SMA also raise bars for the bull’s entry.

EUR/USD wavers around 1.2120-25 during Friday’s Asian session. In doing so, the quote eases from a downward sloping resistance line from January 06 while staying a choppy range between 1.2118 and 1.2142.

Considering the lack of oversold RSI conditions, coupled with the pair’s multiple failures to cross the stated resistance line, EUR/USD sellers are likely to retake controls.

While the 1.2100 threshold can offer immediate support to the quote, the monthly bottom surrounding 1.2050 may lure the EUR/USD sellers afterward.

During the EUR/USD price weakness past-1.2050, September high near 1.2010 and the 1.2000 psychological magnet will be important levels to watch.

On the flip side, a clear break of the immediate resistance line, at 1.2138 now, will eye for another trend line resistance, from January 13, at 1.2165 now.

Even if the EUR/USD manages to cross 1.2165, the 200-bar SMA level of 1.2188 and the December-end low near 1.2210, not to forget the 1.2200 round-figure, can challenge the upside momentum.

EUR/USD four-hour chart

Trend: Pullback expected