- The pair is trading at the critical support level of 1.0150.

- Geopolitical tensions between the US and China continue to rise.

- There is a 46.5% chance that the Fed will deliver a 75bps rate hike.

Today’s EUR/USD price analysis is bearish, in line with a gloomier market climate. The EUR/USD got off to a gloomy start this week. The pair is still descending toward the critical support region that appears to have developed at 1.0150; a break of that level would likely draw sellers and pave the way for a more significant drop.

-Are you looking for automated trading? Check our detailed guide-

Markets are cautious as geopolitical tensions between the US and China continue to rise in the wake of US senators’ weekend visit to Taiwan. Additionally, poor data from China on Retail Sales and Industrial Production reminded investors of the detrimental effects of the nation’s zero-Covid policy on the economy.

In light of the worsening oil crisis and historically high inflation, Bloomberg reported that economists now anticipate the eurozone may experience a technical recession on Monday. According to Bloomberg, “the likelihood of output contracting for two consecutive quarters had increased to 60% from 45% in a previous survey and up from 20% before Russia invaded Ukraine.”

On the other hand, there is currently a 46.5% chance that the Fed will raise the policy rate by 75 basis points in December, according to the CME Group FedWatch Tool.

EUR/USD key events today

The German ZEW Economic Sentiment Index, which measures the six-month economic outlook, will come out today. A value below zero denotes pessimism, which has been the case for a while.

US Building Permits, which track changes in the number of new building permits issued by the government, is also expected.

EUR/USD technical price analysis: Bears aiming at 1.01008

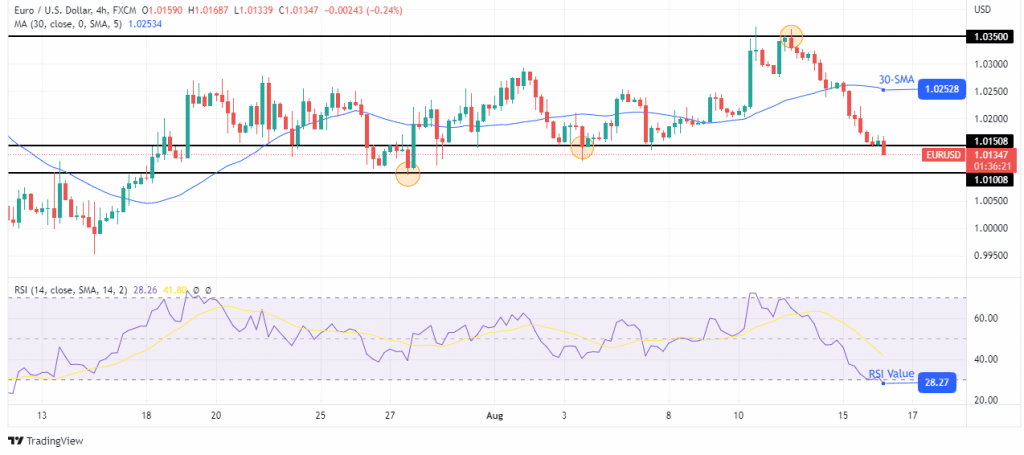

Looking at the 4-hour chart, we see a decisive bearish move starting from the 1.03500 resistance level. The Bears broke through the 30-SMA and paused at the 1.01508 support level before pushing below. A close below 1.01508 could lead to lower prices.

-Are you looking for forex robots? Check our detailed guide-

The RSI is trading close to the oversold region, showing strong bearish momentum. If this momentum continues, bears will head for the next support level at 1.01008. The trend will remain bearish if the price trades below the 30-SMA and the RSI stays below 50.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.