- Investors reduced their expectations of rate reduction in the United States.

- Banking stocks recovered while bonds and interest rate futures partially undid their gains.

- Consumer prices in the United States rose in February, putting pressure on the Fed.

Today’s EUR/USD price analysis is slightly bearish. The dollar gained support on Wednesday as investors reduced their expectations of rate reduction in the United States. Concerns about a banking crisis subsided, and another stubbornly high inflation reading came in.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Overnight, banking stocks recovered while bonds and interest rate futures partially undid their massive gains after three US banks failed.

Interest rate futures predict an 80% chance of a 25 basis point increase in the United States next week.

That is far more hawkish than a day ago when traders priced in a 50% chance of a pause and sharp cuts later in the year due to crisis fears. However, it is also significantly more dovish than a week ago when markets priced a similar likelihood of a 50bps raise.

Consumer prices in the United States rose in February, maintaining the pressure on the Federal Reserve to control price increases.

The Consumer Price Index rose by 0.4% in February. It rose 6.0% in the year ending in February, a slower rate than the 6.4% annualized gain in January but still far below the Fed’s 2% target.

The dollar’s move with higher stock markets and rather calm bond markets indicates that the initial worries of a contagion in the American financial system have subsided.

EUR/USD key events today

When the Producer Price Index report is released, investors will get more US inflation data. There will also be a retail sales report showing the state of consumer spending in the US.

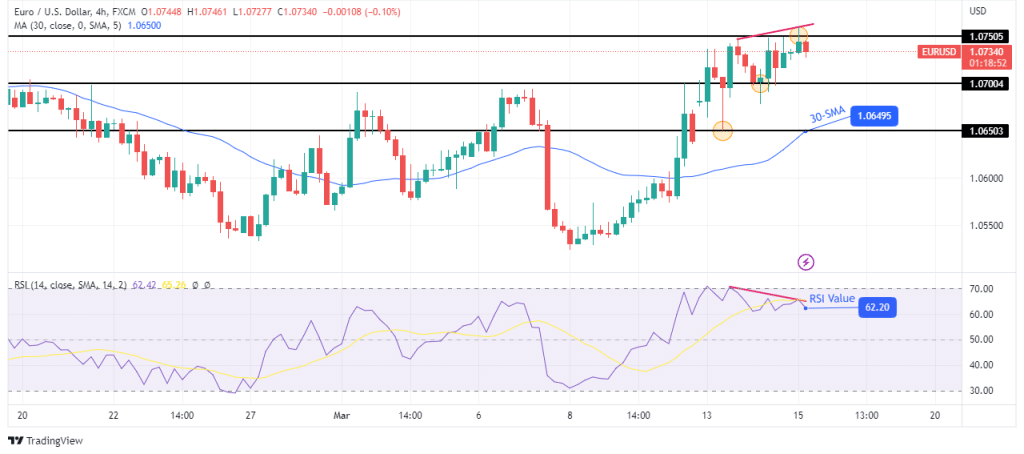

EUR/USD technical price analysis: Bearish divergence points to weakness

The 4-hour chart shows EUR/USD trading above the 30-SMA and the RSI above 50, showing a bullish move. However, the bullish move has paused at the 1.0750 resistance level and oscillates with support at the 1.0700 support.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

At the same time, the RSI is showing weakness in the move as it has made a bearish divergence. We might see a bigger pullback to the 30-SMA support if this divergence continues. However, if bulls get stronger, we might see a break above the 1.0750 resistance.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money