- Next week, the Fed and the European Central Bank will make interest rate decisions.

- Investors are looking forward to the US producer pricing data for November.

- The US dollar is down over 6% for Q4.

Today’s EUR/USD price analysis is bullish. The dollar lost ground against the Euro as investors assessed US Federal Reserve policy prospects against the likelihood that rising interest rates could trigger a recession.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

Next week, the Fed, the European Central Bank, and the Bank of England will make interest rate decisions. Policymakers continue applying brakes to economic growth by raising rates to combat persistently rising inflation.

Investors and traders will look for indications that the Fed is about to pause its rate hikes.

In addition, investors are looking forward to the US producer pricing data for November due out on Friday.

According to Refinitiv data, the US dollar index is still up over 9.5% for the year, but it is down more than 6% for the fourth quarter. It is on track for its largest quarterly decrease since the third quarter of 2010, when it fell 8.5%.

Investors are shifting their funds away from overvalued markets in the United States and toward undervalued markets abroad, according to Karl Schamotta, chief market strategist at Corpay in Toronto. “Inflation risks are waning, and the Fed’s path is becoming more predictable just as fuel prices drop geopolitical tensions ebb, and China starts its reopening process,” he said.

“All of this could come to an abrupt end next week if inflation jumps to the upside and the Fed seems more hawkish than anticipated.”

EUR/USD key events today

The US will report the Producer Price Index, an indicator of consumer inflation. This might cause a lot of volatility if it surprises markets.

EUR/USD technical price analysis: A break above 1.0585 is on the cards

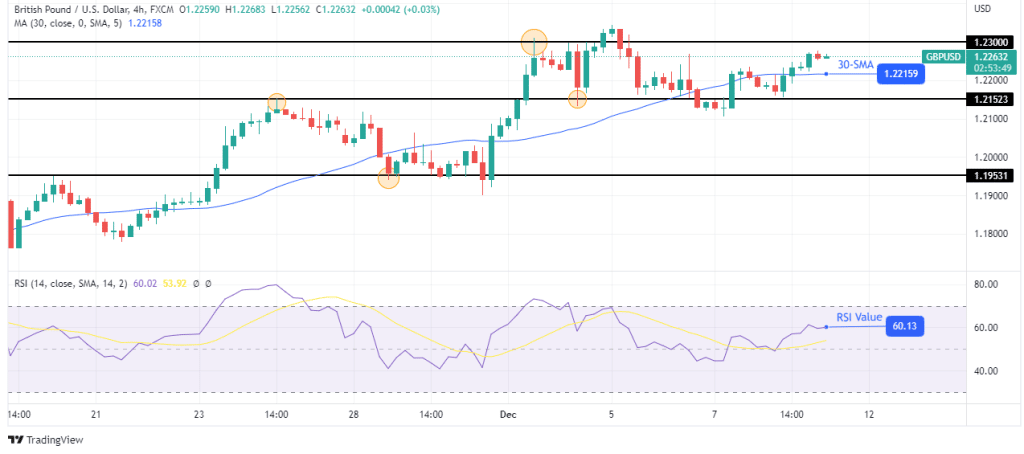

The price in the 4-hour chart is trading above the 30-SMA and the RSI above 50, pointing to a bullish move. The price had initially made a lower high at 1.0550, where sellers took over. They, however, failed to reverse the trend as they came against a strong resistance zone.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

The resistance zone comprised the 1.0490 support, the bullish trendline, and the 30-SMA. This allowed the buyers to return with enough strength to break above 1.0550. The current bullish move will most likely take out the resistance at 1.0585.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.