- The EUR/USD pair maintains a bearish bias despite temporary rebounds.

- The 1.0000 psychological level could stop the sell-off.

- Stabilizing below the S1 could announce more declines.

The EUR/USD price accelerated its sell-off as the Dollar Index resumed its upwards movement. It was traded at 1.0005 at the time of writing, and it seems heavy as the DXY is strongly bullish. The currency pair dropped as much as 0.9999 registering a new lower low. It has dropped below parity, but it remains to see how it will react after reaching the 1.0000 key level.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Technically, after its massive drop, we cannot exclude a temporary rebound. The rate could come back to test and retest the near-term resistance levels before coming back down.

Fundamentally, the USD dominates the currency market as the FED is expected to hike rates again in the July meeting. A 50bps or a 75bps increase is expected as the high inflationary pressure.

Today, the Euro took a hit from the Euro-zone ZEW Economic Sentiment, which came in at -51.1 points below -39.0 points expected and compared to -28.0 in the previous reporting period. Also, the German ZEW Economic Sentiment dropped unexpectedly lower from -28.0 to -53.8 points below -40.6 estimates.

Later, the IBD/TIPP Economic Optimism is expected at 40.3 points. Tomorrow, the US CPI and the Core CPI are seen as high-impact events and could really shake the markets.

EUR/USD price technical analysis: Extending bearish momentum to parity

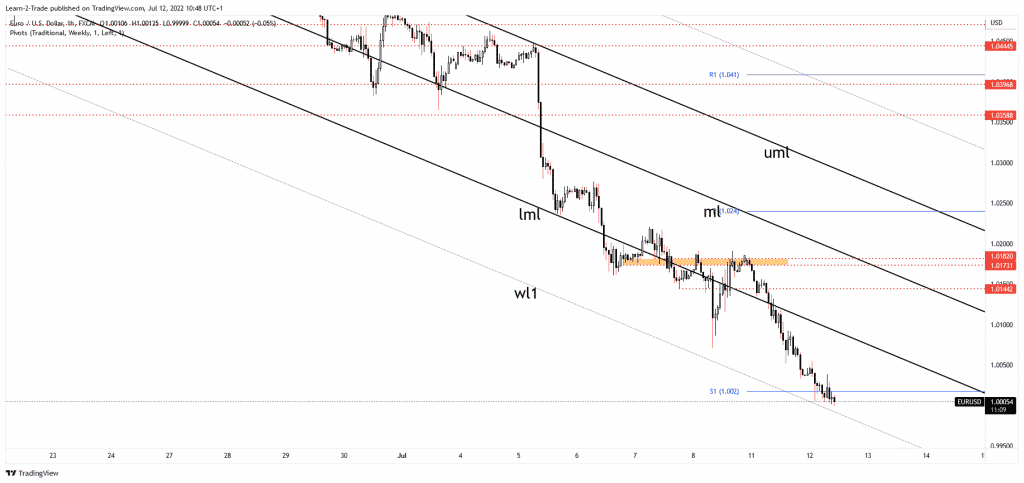

The EUR/USD pair extended its sell-off after testing and retesting the 1.0182 resistance level. It has dropped below the weekly S1 (1.0020) but failed to reach the first warning line (wl1), which stands as a dynamic support. The 1.000 psychological level represents a major downside obstacle, so we cannot exclude a rebound from around parity.

–Are you interested to learn about forex robots? Check our detailed guide-

Still, the bias remains bearish as long as it stays below the lower median line (LML). This line stands as a dynamic resistance. A temporary rebound could bring new selling opportunities. The 1.0071 former low is seen as static resistance. Only stabilizing below the weekly S1 (1.0020) could signal more declines towards fresh new lows.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money