- As oil prices start falling from a 14-year high, the EUR/USD pair is attempting a slight correction higher.

- Traders seek clarification from the ECB on the updated dovish stance versus the Fed.

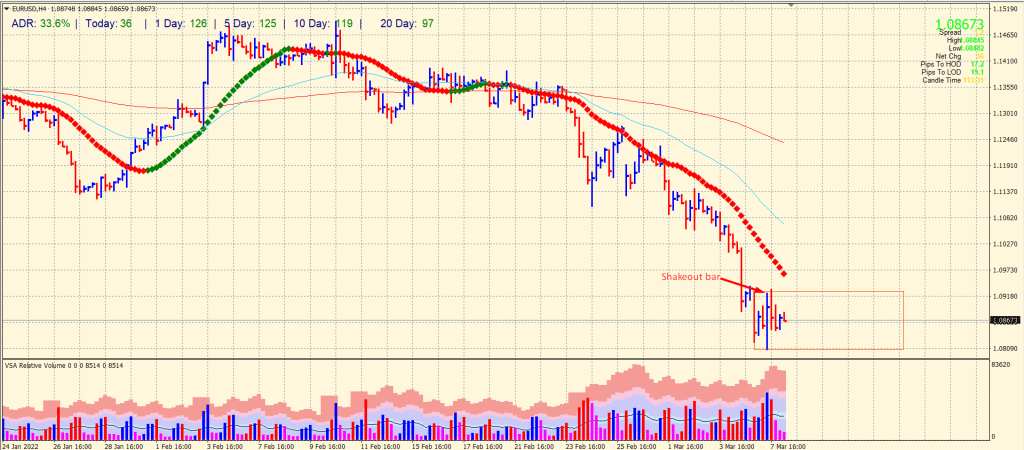

- The EUR/USD currency pair is trying to correct higher in Asia, following yesterday’s example when it settled near a 22-month low just above 1.08.

The EUR/USD price analysis turns a little positive after hitting lows near 1.0800 on Monday. However, the pair managed to gain traction later.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

The Ukraine situation is a black cloud over Europe’s economic outlook based on central bank divergence. On Monday, investors weighed the impact of oil prices on the global economy, helping the dollar rise. The dollar index hit a 14-year high on Tuesday but is lagging, bringing some relief to the euro.

Oil crunch

In light of an import ban on Russian oil, the world’s benchmark oil price, Brent crude, is now trading at $138 a barrel, pushing the US dollar higher. On the previous day, the Dollar Index (DXY), which measures the dollar’s value against six global peers, also traded above 99.42, sending the euro down 4% against the dollar after Russia announced a “special military operation” had begun in Ukraine.

What’s next for the EUR/USD price analysis?

Due to the economic consequences of the war for the Eurozone, maximum flexibility will be required from the ECB on the path to normalization. Therefore, a divergence between the ECB and Federal Reserve will make 1.0800 vulnerable in the coming days, depending on the ECB’s results.

There will be no Fed speakers the following week due to a media embargo, but the market is fully prepared for a 25-basis point rally on March 16 to kick off a tightening cycle.

EUR/USD price technical analysis: Bulls attempting a rally

The EUR/USD price hit the 1.0800 mark with a very high volume, followed by a shakeout bar with an even higher volume. The pair is then wobbling within the range of the shakeout bar. Any break above the highs of the range will gather more buying and aim for 1.0950 ahead of 1.1000.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

On the flip side, 1.0800 will be key support ahead of 1.0725. Although the trend is bearish, the prospects of upside correction are very high after dipping more than 700 pips in a month.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money