- A temporary rebound was natural after a strong sell-off of the EUR/USD.

- The bounce-back could bring new short opportunities.

- The bias remains bearish as long as it stays under the median line (ml).

The EUR/USD price started to rise after reaching 1.0874. The price rebounded as the Dollar Index turned to the downside ahead of FOMC.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

Technically, the DXY was somehow expected to retreat after its amazing leg higher. It could test the immediate downside obstacles before resuming its growth. As long as the DXY drops, the EUR/USD pair will be expected to grow. Still, from the technical point of view, the currency pair could develop only a temporary rebound. Bouncing back could help the sellers to catch a new bearish momentum.

Surprisingly or not, the EUR/USD pair grew even though the Eurozone data came in worse than expected. The German Factory Orders registered a 2.2% drop compared to the 0.2% drop expected, while the PPI rose by 1.1% less versus 1.2% estimates. Later, Treasury Sec Yellen’s speech may bring some volatility.

Finally, though, the most important event is represented by the FOMC Meeting Minutes. Definitely, this will bring sharp movements and will shake the markets.

Tomorrow, the US Unemployment Claims, Eurozone Retail Sales, and German Industrial Production could impact.

EUR/USD price technical analysis: Bounce-off pauses bears

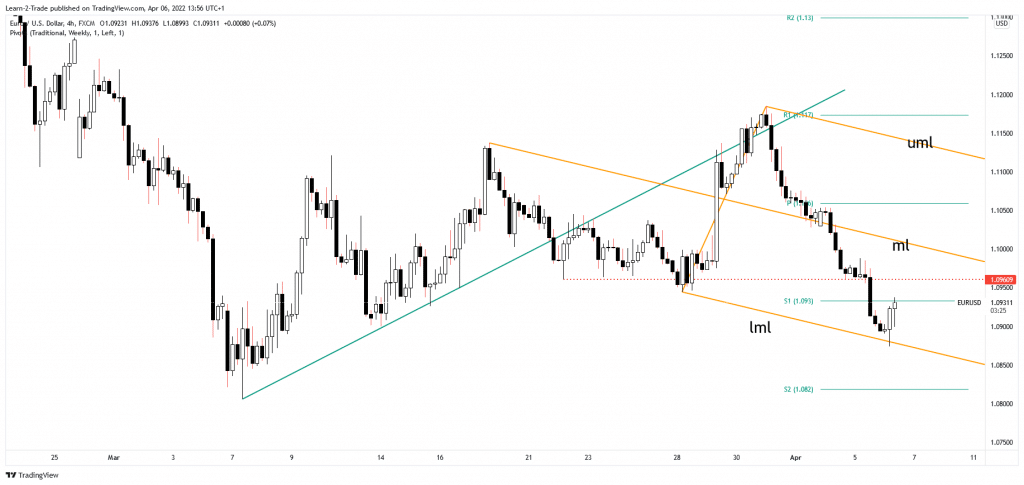

As you can see on the 4-hour chart, the EUR/USD pair found support right on the descending pitchfork’s lower median line (LML), which represents dynamic support. Now, the pair is fighting hard to rebound. But, first, it challenges the weekly S1 (1.0930).

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

This obstacle may signal potential growth towards a 1.0960 static resistance level. Also, we cannot exclude a larger rebound towards the 1.1 and up to the median line (ml). The median line (ml) could attract the price after registering a false breakdown with great separation below the lower median line (LML).

The bias remains bearish as long as the rate stays below the median line (ml) and under the 1.0960 obstacle. Staying below these levels could bring new short opportunities. The price could come back only to confirm the breakdown below 1.0960. Also, after its massive drop, a rebound is natural.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money