- Closing the gap may signal a more significant rebound.

- A new lower low activates a downside continuation.

- The bias remains bearish despite temporary rebounds.

The EUR/USD price gained slightly on Monday as the Dollar Index retreated some gains after an amazing rally.

–Are you interested in learning more about forex signals? Check our detailed guide-

The pair rebounded after reaching the daily low of 0.9877. The pair is trading around 0.9941 at the time of writing. After a considerable drop, a temporary rebound is natural.

The Non-Farm Payrolls boosted the USD on Friday. The indicator came in at 315K in August versus 295K expected but below the 526K in July.

The greenback dominated the currency market even though the US Unemployment Rate was reported at 3.7%, above 3.5% expected, while the Average Hourly Earnings rose by 0.3%, less than 0.4% forecasted. Also, the Factory Orders registered a 1.0% drop even if the specialists expected a 0.2% growth.

Today, the Eurozone Retail Sales reported 0.3% growth, matching expectations. German Final Services PMI dropped unexpectedly from 48.2 points to 47.7 points, and Sentix Investor Confidence came in at -31.8 points, far below the -26.8 estimated.

In contrast, the Euro-zone Final Services PMI dropped from 50.2 points to 49.8 points below 50.2, which is expected to be a signaling contraction. The US banks will be closed in observance of Labor Day. The RBA, BOC, and ECB could shake the week’s markets.

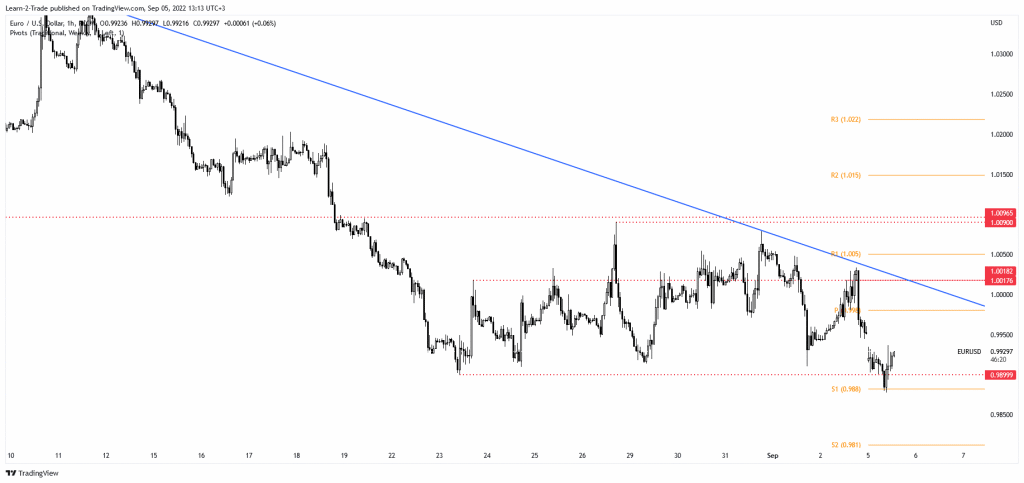

EUR/USD price technical analysis: Monday opening with gap down

From the technical point of view, the EUR/USD pair plunged after failing to make a new higher high or stabilize above parity. It has dropped below 0.9899 but failed to stay below this downside obstacle.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

The price could try to close the gap down. Failing to close it may signal intense downside pressure. After its strong sell-off, temporary growth was natural. Coming back below 0.9899 and making a new lower low could activate more declines.

The weekly S1 (0.9880) stands as a downside obstacle. A new lower low could bring short opportunities as well. Only staying above 0.9899 and closing the gap down could activate a meaningful recovery.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.