- The EUR/USD pair could approach new lows if the Dollar Index resumes its leg higher.

- A new lower low could activate a downside reversal.

- After its massive drop, a temporary rebound is in the cards.

The EUR/USD price drops as the Dollar Index has managed to resume its leg higher. There is a strong negative correlation between these two. DXY’s upside continuation should push the currency pair towards new lows.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

The price dropped deeper and reached the 1.0981 level even though the US Non-Farm Employment Change disappointed on Friday. As you already know, the NFP came in at 431K in March versus 492K expected and after 750K in February. Unfortunately for the USD, the ISM Manufacturing PMI dropped from 58.6 points to 57.1, signaling a slowdown in expansion.

On the other hand, the US Unemployment Rate supported the USD, which dropped from 3.8% to 3.6% below 3.7% estimates, while the Average Hourly Earnings rose by 0.4%, matching expectations.

The US Factory Orders reported a 0.5% drop in February, matching expectations. In the short term, the Euro dropped versus all its rivals. The German Trade Balance was reported at 11.5B above 11.3B expected, compared to 8.8B in the previous reporting period.

In addition, Sentix Investor Confidence came in at -18.0 points below -9.3 expected, while the Spanish Unemployment Change was reported at -2.9K versus 15.3K expected. The US ISM Services PMI and the Euro-zone and German services data could bring volatility tomorrow.

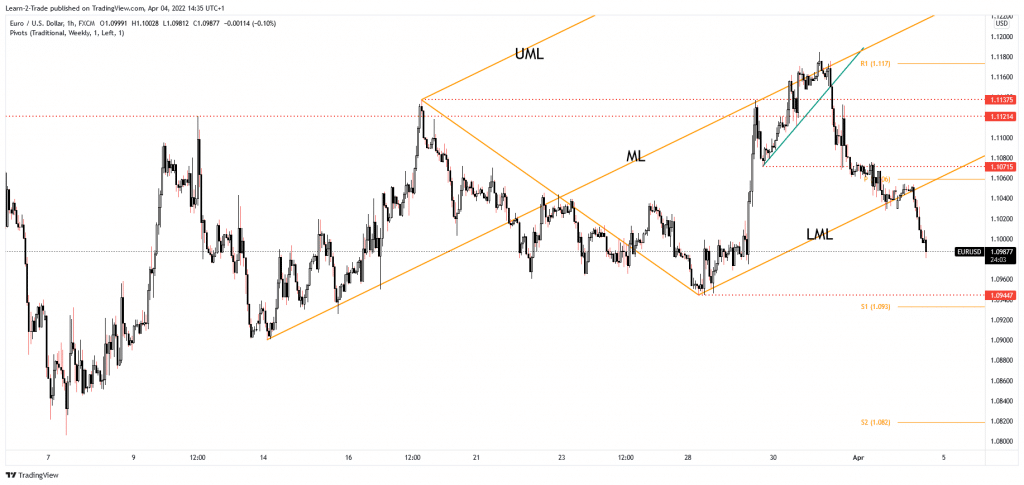

EUR/USD price technical analysis: Bears pick strength

The EUR/USD pair accelerates its sell-off after dropping below the ascending pitchfork’s lower median line (LML). The next downside target is represented by 1.0944. Failing to stay above the 1.1121 – 1.1137 area confirmed that the swing higher is over and that the bears could take complete control.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

The pair has escaped from the ascending pitchfork’s body, signaling more declines. Technically, a valid breakdown below 1.0944 former low could activate a more significant downside movement. Actually, a valid breakdown below this level could activate a bearish reversal. Still, after the current sell-off, the EUR/USD pair could develop a temporary rebound.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money