- The bias remains bearish despite the current rebound.

- Powell’s remarks could really shake the markets later today.

- A new higher high activates a larger rebound.

The EUR/USD price rebounded in the short term as the Dollar Index temporarily corrected lower. DXY’s drop forced the greenback to lose ground versus its rivals.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Still, you should know that the index may find a short-term retreat after its amazing rally. You already know that the FED is expected to continue hiking rates in the next monetary policy meeting. A 50bps hike is expected in September. That’s why the USD remains strong despite minor depreciations.

The currency pair was trading at 1.0002 at the time of writing. It remains to see how it will react around parity. Fundamentally, the German Gfk Consumer Climate came in worse than expected today.

The Fed Chair Powell Speaks and the Core PCE Price Index are high-impact events. So, the volatility could be huge later. You have to be careful if you are not an experienced trader. In addition, Revised UoM Consumer Sentiment could jump from 55.1 to 55.3 points, Personal Spending could report a 0.4% growth, and Personal Income is expected to register a 0.6% growth. In contrast, the Goods Trade Balance is expected at -98.5B versus -98.6B in the previous reporting period.

EUR/USD price technical analysis: Potential rebound

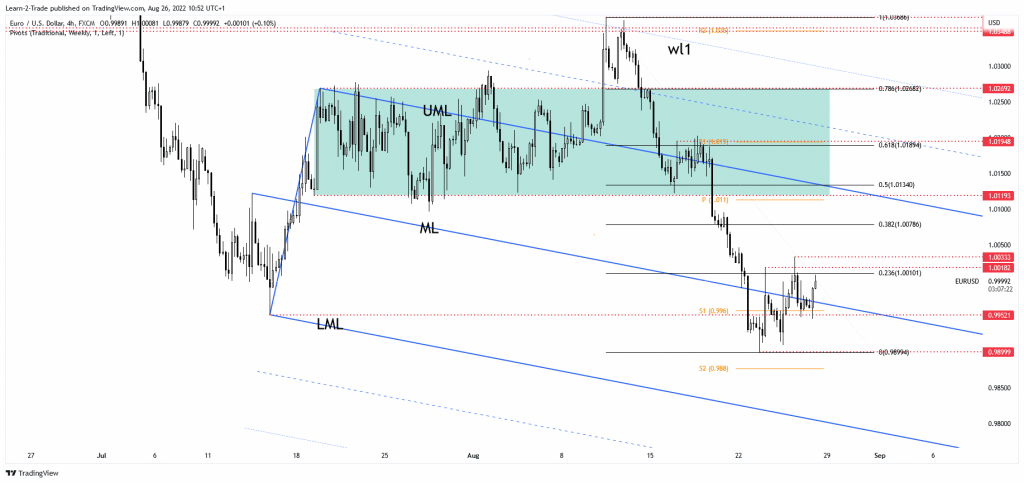

The EUR/USD pair found support at 0.9899 and now is struggling to resume its rebound. It has managed to stay above the weekly S1 of 0.996 and may challenge the 23.6% (1.0010) retracement level.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

The 1.0018 and 1.0033 level represent upside targets as well. Technically, the throwback could be temporary. It could come back to test the near-term resistance levels before resuming its downside movement.

Taking out the near-term resistance levels could announce further growth and a larger rebound. The 1.0119 and the upper median line (UML) are major upside obstacles.

On the contrary, staying below parity after testing and retesting the upside obstacles could announce that the rebound ended and that the rate could turn to the downside again.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.