- The EUR/USD pair maintains a bullish bias in the short term as long as it stays above the support zone.

- The median line (ml) is a magnet and could attract the price.

- The US inflation data could change the sentiment.

The EUR/USD price retreated after reaching 1.0034 yesterday. It has retreated a little, but the bias remains bullish as the US dollar remains under pressure.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

As you already know, the greenback lost significant ground versus its rivals after the US Unemployment Rate jumped from 3.5% to 3.7%, above 3.6% in October. The Euro received a helping hand from German Industrial Production yesterday. The indicator came in better than expected.

Fundamentally, the US inflation data could be decisive on Thursday. The CPI and Core CPI represent high-impact events and could change the sentiment. The Consumer Price Index is expected to report a 0.6% growth in October versus 0.4% growth in September, while Core CPI may report a 0.5% growth.

Higher inflation could lift the USD as the FED should continue hiking rates. A 50 bps hike is expected in December, but higher-than-expected inflation could force the Federal Reserve to increase the Federal Funds Rate by 75 bps again.

Today, the Eurozone Retail Sales are expected to report a 0.4% growth in September versus the 0.3% drop in August. Lanter, we cannot exclude strong moves around the Congressional Elections. This is seen as a high-impact event and could change the sentiment. Furthermore, the US is to release the IBD/TIPP Economic Optimism and NFIB Small Business Index.

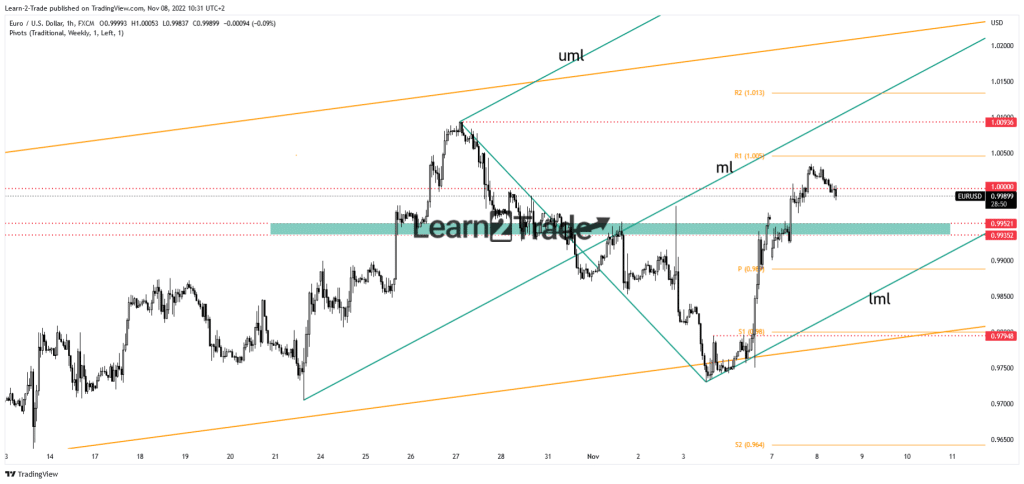

EUR/USD price technical analysis: Retreating from parity

As you can see on the hourly chart, the rate dropped below parity again. After its strong growth, a retreat was natural. Its failure to stabilize above the 1.0000 key level signaled exhausted buyers. DXY’s rebound forced the USD to take the lead in the short term.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

Technically, the 0.9935 – 0.9952 represents a demand zone, a downside obstacle. As long as it stays above this zone, the EUR/USD pair could give birth to a new bullish momentum and try to resume its leg higher.

Failing to stabilize below the up trendline, followed by the false breakdown with great separation through this line and below the lower median line (LML) on Friday, signaled a potential leg higher towards the median line (ml). As long as it stays within the ascending pitchfork’s body, the median line could attract the rate.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.