- The EUR / USD bounces back from a three-week slide with recent gains.

- German bond yields hit a 32-month high, while US bond coupons declined from March 2021 levels.

- Fed policymakers hope for stronger NFPs, but ECB policymakers may be unhappy with higher inflation.

Before Friday’s European session, the EUR/USD price remains in equilibrium at around 1.1300. It seems like traders are mostly out ahead of US NFP.

–Are you interested to learn more about Nigerian forex brokers? Check our detailed guide-

Amid mixed fears and cautious sentiment about the consumer price index (CPI) of the Eurozone for December and the US labor market report for this month, the main currency licks the wounds left by the FOMC protocol. The price remains on track for its first negative close in three weeks as bears cheer on firmer returns.

The EUR/USD pair is likely to recover ahead of the European session in hopes of overcoming the negative yield on German bonds. Germany’s inflation indicator, the Harmonized Consumer Price Index (HICP), fell in December and coincided with negative forecasts the day before, causing bond yields to jump to their highest level since May 2019.

Martins Kazaks, chairman of Latvia’s central bank and ECB councilor, said the ECB is prepared to raise rates if needed.

The EUR/USD buyers have benefited from the recent decline in US bond yields. The recent decline in US manufacturing orders, weekly jobless claims, the ISM Services PMI, and a good trade balance might be related.

Nevertheless, the hawkish tone of Fedspeak and the FOMC protocols, which have previously boosted yields by raising rates for faster Fed rate hikes, are encouraging signs. However, St. Louis Fed President James Bullard pushed for a rate hike in March, while San Francisco Federal Reserve Bank President and FOMC member Mary S. Daly emphasized the need for rate increases to keep the economy moving.

As a result of these developments, 10-year US Treasury yields are consolidating recent gains to a nine-month high, and S&P 500 and EuroStoxx Future futures are showing modest gains. However, gloomy sentiment persists due to escalating Covid concerns and recent US-China disputes over human rights and trade.

In the coming weeks, the Eurozone CPI, which is expected to decline from 4.9% y/y to 4.7%, could allow bears to regain control of the EUR/USD pair before the employment report in the USA. The inflation may rise above the 4.7% forecast, but pandemic worries will challenge the ECB’s hawkish rhetoric and keep the pair under pressure.

While the US nonfarm payroll (NFP) is expected to increase from 210,000 to 400,000, the unemployment rate may fall from 4.2% to 4.1%. However, the underemployment rate is expected to rise from 7.8% to 8%. Nevertheless, firmer expectations from the US labor market report could help the Fed hawks take the initiative, putting pressure on EUR/USD prices.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

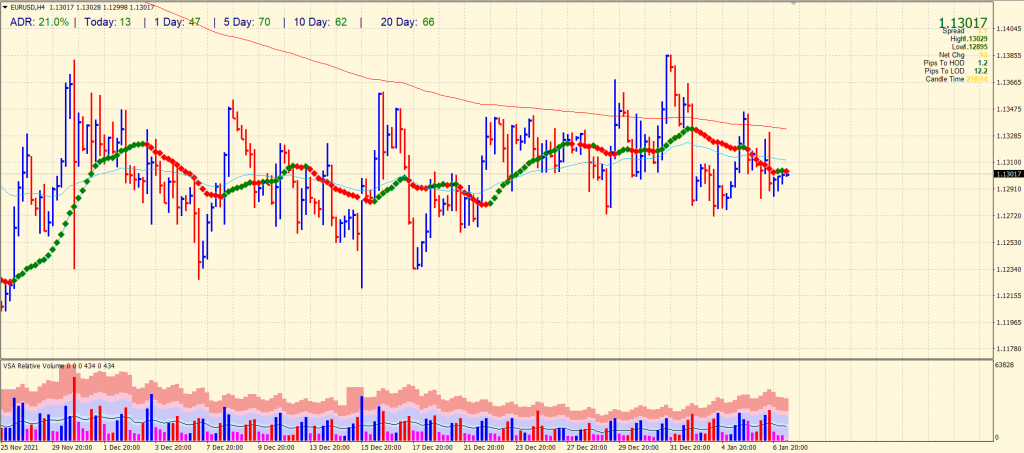

EUR/USD price technical analysis: Shallow pullback

The EUR/USD price maintains a rangebound behavior. Although the pair is trying to gain back losses, the widespread down bar with a very high volume suggests a strong bearish momentum. So, the pullback seems shallow. However, staying above the 1.1300 level may gradually neutralize the bears. Bulls will remain weak unless the price breaks highs of 1.1385.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.