- The EUR/USD pair maintains a bearish bias despite temporary rebounds.

- A new lower low activates more declines.

- The US inflation data could bring sharp movements in both directions.

The EUR/USD price is trading around 0.9700 at the time of writing. It seems undecided in the short term. The traders are waiting for the US inflation data. That’s why the price changed a little.

Most likely, the price will register sharp movements before and after the US data dump. The Consumer Price Index is expected to report a 0.2% growth in September versus the 0.1% growth in August, while the Core CPI may register a 0.4% growth in the last month versus the 0.6% growth in the previous reporting period.

In addition, the CPI y/y is expected at 8.1%, below 8.3% in the previous reporting period. At the same time, Unemployment Claims could be reported at 225K in the previous week versus 219K in the previous reporting period.

Anything could happen after the US economic figures. The EUR/USD pair could register sharp movements in both directions. Higher inflation reported by the US could push the greenback higher as the FED needs to take action in the next monetary policy meeting again.

Tomorrow, the US will release the retail sales data and the Prelim UoM Consumer Sentiment, representing high-impact events.

EUR/USD price technical analysis: Bearish bias

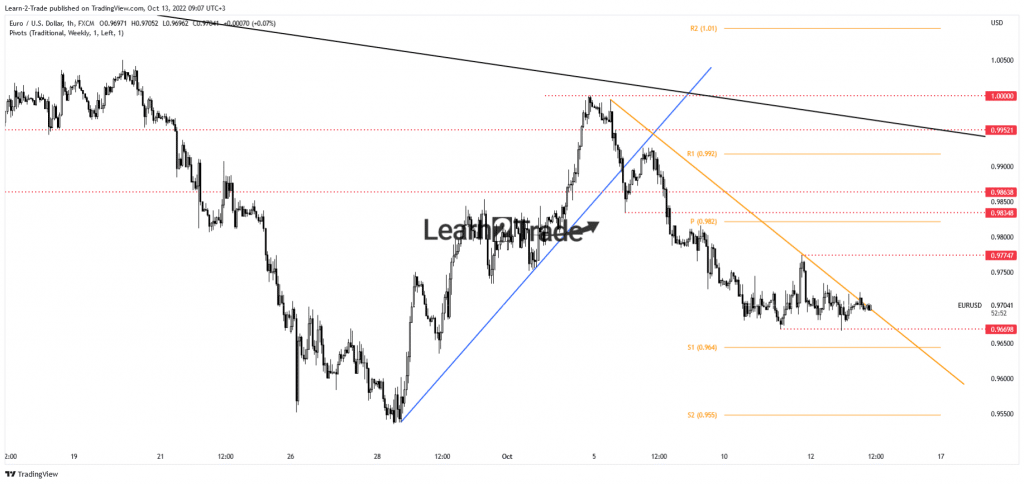

Technically, the EUR/USD pair challenges the immediate down trendline after failing to make a new lower low. It’s trapped between 0.9669 and 0.9774 levels. So, it can move sideways ahead of the US inflation figures. The bias remains bearish after failing to jump above the 1.0000 psychological level or the major downtrend line. A new lower low activates more declines.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

After its massive drop, we cannot exclude a temporary rebound. A larger growth could be activated after making a new higher high. False breakouts above the near-term resistance levels may signal a new sell-off. The weekly S1 (0.9640) stands as a downside obstacle as well. Taking out this support validates a potential drop toward the S2 (0.9550). Lower inflation could push the rate higher in the coming days.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.