- The EUR/USD pair drops as the Dollar Index has managed to rebound.

- The US economic data could bring some volatility later.

- Taking out the support represented by the uptrend line could announce more declines.

The EUR/USD price dropped today as the Dollar Index managed to rebound. Still, the DXY remains under solid downside pressure. Hence, it’s premature to talk about a fresh bearish trend in the EUR/USD.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

Technically, the currency pair continues to move sideways in the short term. The price action failed to confirm a more significant upside movement. Fundamentally, the EUR/USD pair dropped because the ISM Manufacturing PMI came in better than expected yesterday. The indicator was reported at 52.8 points above 52.3 points expected.

Today, the US JOLTS JOB Openings are expected to drop from 11.25M to 10.99M, which could be bad for the greenback. This is seen as a high-impact event so the volatility could be huge. In addition, Wards Total Vehicle Sales could be reported at 13.4M.

Tomorrow, the US Services PMI, Factory Orders, Final Services PMI, the German Trade Balance, German Final Services PMI, Euro-zone Retail Sales, Euro-zone Final Services PMI, and the Eurozone PPI could bring more action.

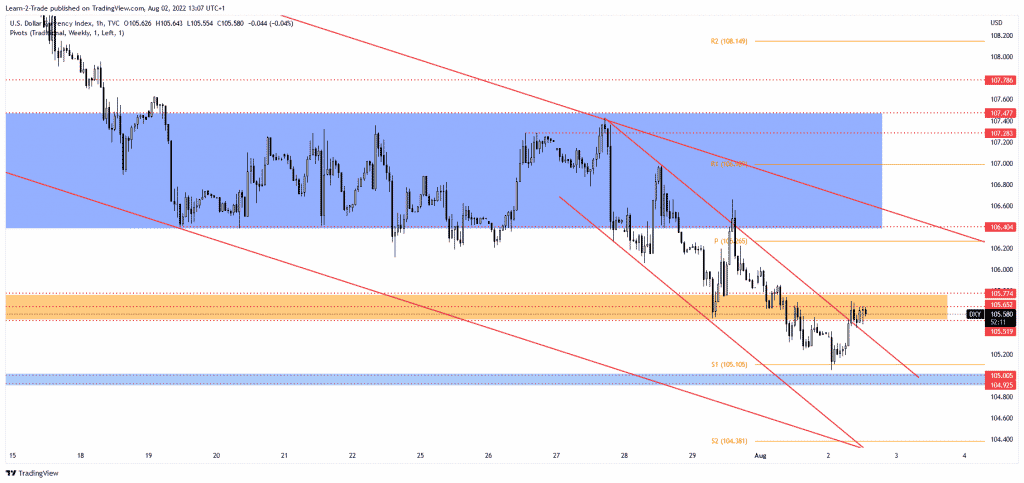

Dollar Index price technical analysis: Upside pressure

The Dollar Index found support on the weekly S1 (105.10), and now it is trying to develop a new leg higher. It was traded at 105.65 and seemed determined to approach the 105.77 immediate upside obstacle.

Technically, after failing to reach and retest the 105.00 psychological level, the DXY escaped from the down channel pattern signaling that the downside movement could be over and that the index could return higher. The major downtrend line represents the significant resistance.

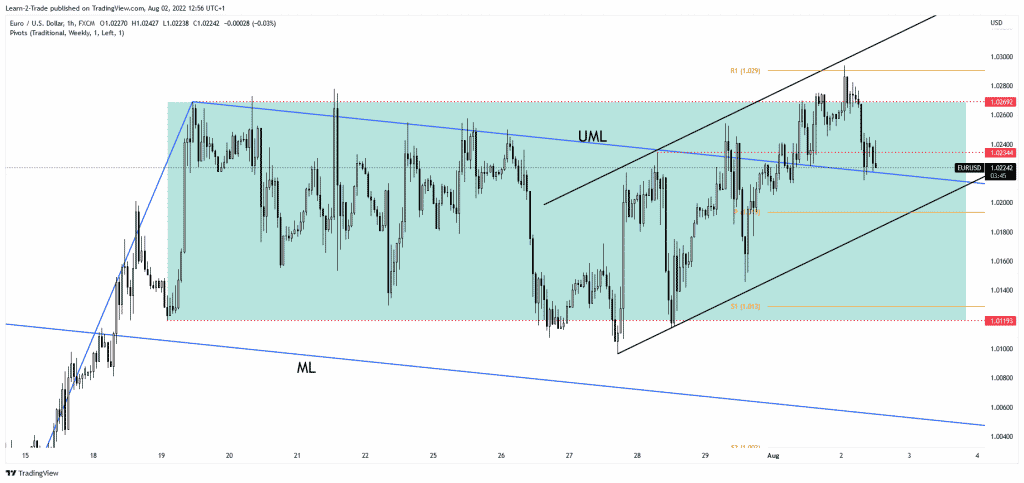

EUR/USD price technical analysis: Uptrend channel

The EUR/USD pair challenges the descending pitchfork’s upper median line (UML), representing dynamic support (resistance turned into support). As you can see on the 1-hour chart, the rate is trapped within an extended sideways movement between 1.0269 and 1.0119 and within an up channel.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Breaking these patterns could bring us new opportunities. As long as it stays above the uptrend line, the currency pair could still resume its swing higher. Taking out the support represented by the uptrend line could activate more declines towards 1.0119. Its false breakout above 1.0269 could signal that the buyers are exhausted and that a new leg down is in the cards.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.