- EUR/USD remains in a tight range, mildly supported by the 1.1700 mark.

- Dollar bulls hold momentum amid Fed’s hawkishness and rise in bonds yields.

- US CPI is the key risk event on the day that may provide fresh impetus to the market.

The EUR/USD price is trading near 1.1700 and has pushed back from 1.1725 high as bears take a breather during a quiet session in the lead-up to European trade on Wednesday. Before the main US inflation figures for July were released, the major currency pair fell eight times in a row.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Although the lack of key data or development in Asia suggests the decline is heading for a bottom, bears remain optimistic, as the US infrastructure spending plan underpins disaster risk reduction, and the dollar remains a safe haven. In addition, virus concerns could also impact the dollar in Western countries as well as Asia-Pacific.

Despite two more hurdles to overcome before embarking on the $1.2 trillion infrastructure bailout, dollar bulls appear to have had their backs turned as policymakers struggle to break the all-important debt line.

Furthermore, news from Reuters indicating the EU won’t change its safe travel list this week while allowing non-essential travel from the United States to continue. However, a rise in COVID cases is helping the Euro a little compared to its USA counterpart.

With these results in mind, the US Dollar Index (DXY) has reached a new high of around 93.20, adding to a four-day winning streak. Thus, despite an apparent rise in yields on US Treasury bonds, the dollar indicator remains weak and supports declining stock futures.

The remarks made by Atlanta Federal Reserve President Rafael Bostic, Richmond Fed President Thomas Barkin, and Chicago Fed President Charles Evans contrast with those made by the European Central Bank (ECB) policymakers.

Therefore, the EUR/USD traders will be watching closely for July’s US inflation data, which is expected to drop from 5.4% to 5.3% YoY to confirm the recent trend, which is also favorable for the dollar.

–Are you interested to learn more about crypto signals? Check our detailed guide-

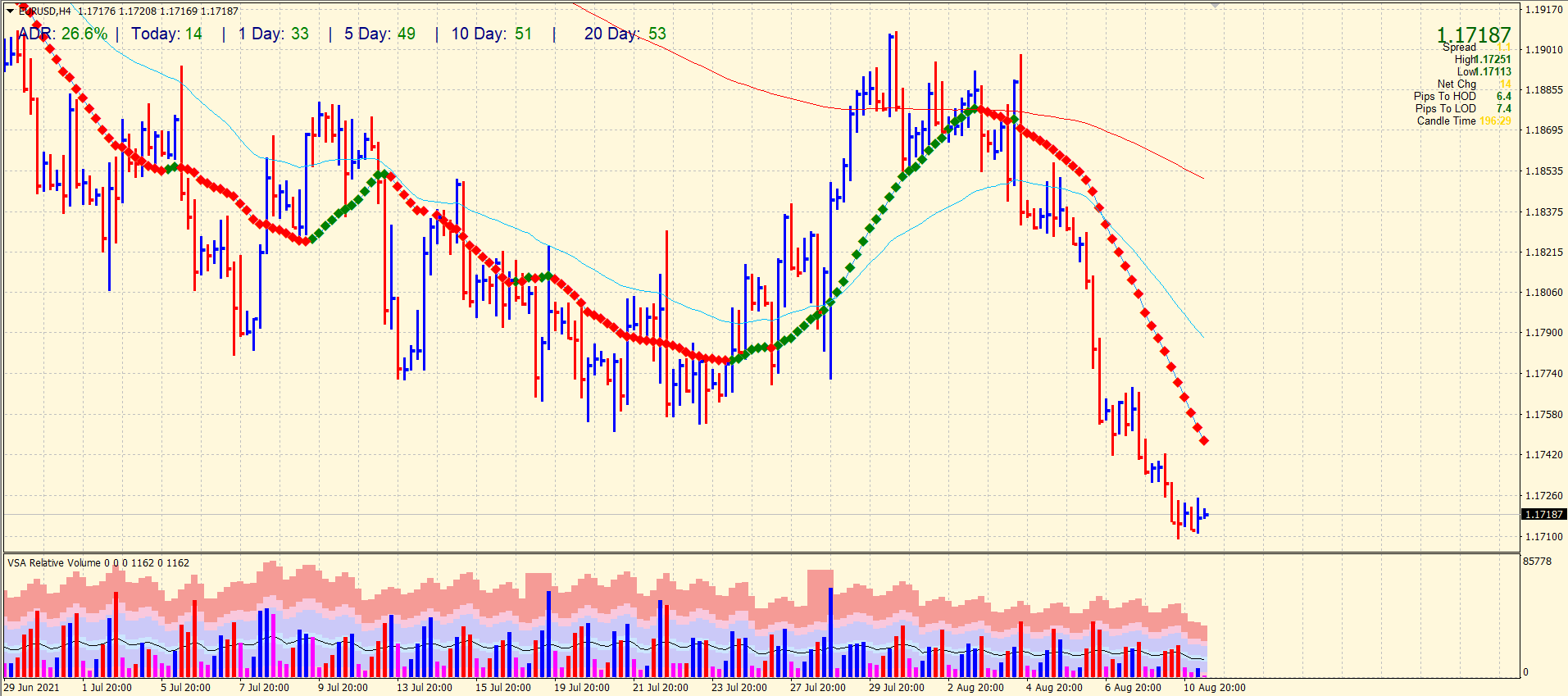

EUR/USD price technical analysis: Consolidation to continue

The EUR/USD pair found mild support at a 1.1700 handle. However, the price structure is still quite feeble to retrace further up. The volume is clearly giving clues about more bearish bias ahead on the 4-hour chart. However, a probability of testing 20-period SMA still exists, which is now at 1.1740 area. So far, the average daily range is 26% for the day. It shows that the pair has not yet started any clear move on either side.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.