- The EUR/USD pair could bring new trading opportunities after escaping from the current range.

- A new lower low activates more declines.

- DXY’s further growth should push the USD higher versus its rivals.

The EUR/USD price drops as the Dollar Index managed to jump higher and erase its minor losses. The pair is trading around 1.0660 at the time of writing. It seems vulnerable to slide further. DXY’s further growth should force the USD to appreciate versus its rivals.

-Are you interested in learning about the best AI trading forex brokers? Click here for details-

The greenback started to dominate the currency market after the US Non-Farm Employment Change publication. The NFP came in at 390K in May versus 325K expected, which was good for the USD. The dollar rallied in the short term even if the Average Hourly Earnings and the Unemployment Rate came in worse than expected.

Today, the USD received a helping hand from the US Trade Balance. The economic indicator came in at -87.1B versus -89.6B estimates compared to -109.8B in the previous reporting period. On the other hand, the German Factory Orders punished the EUR, which reported a 2.7% fall even if the traders expected a 0.4% growth. Later, the Treasury Sec Yellen Speaks could bring more action.

Fundamentally, the US inflation data and the ECB could shake the markets at the end of the week. These high-impact events could change the sentiment. That’s why you have to be careful.

EUR/USD price technical analysis: Range pattern

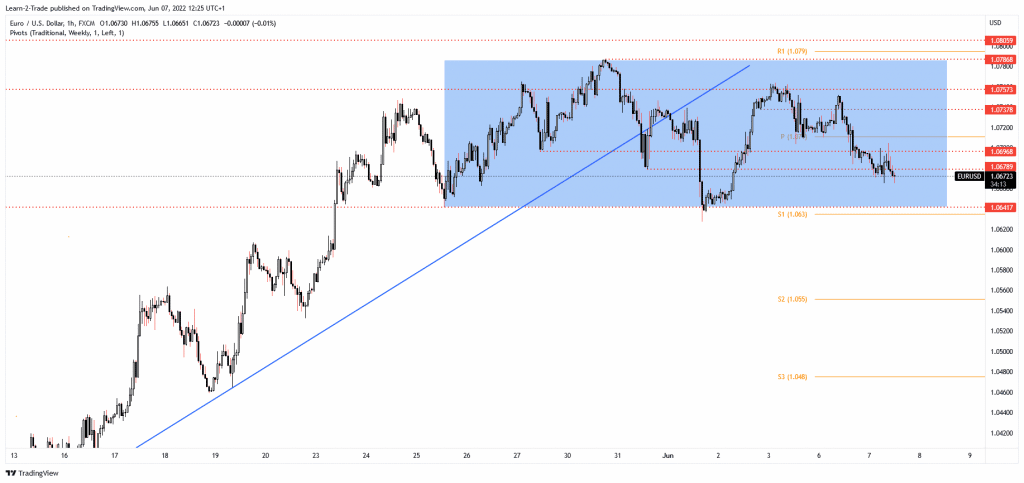

As you can see on the 1-hour chart, the EUR/USD pair is trapped between 1.0641 and 1.0786 levels. The short-term rebound was stopped by the 1.0757 key resistance. Now, the price has almost reached 1.0641 critical support.

-Are you interested in learning about the forex indicators? Click here for details-

A valid breakdown through this level could open the door for a larger downside movement. A new lower low could bring more sellers into the game. Still, we’ll have to wait to see how the rate will react around this level. False breakdowns could signal a new upside momentum.

Technically, the EUR/USD pair signaled that the swing higher ended after failing to stabilize above 1.0757 and after breaking below the up trendline.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money