- The EUR/USD pair maintains a bullish one after failing to stay below the uptrend line.

- A new higher high activates further growth.

- The FOMC Meeting Minutes weakened the greenback.

The EUR/USD price rallied beyond 1.0400, posting daily highs around 1.0450. The USD lost significant ground versus its rivals.

-Are you interested in learning about the forex signals telegram group? Click here for details-

The US reported lower inflation in October, which raised hopes for Fed’s slowdown. The greenback extended its drop after the US Flash Manufacturing PMI dropped from 50.4 to 47.6, far below 50.0 expected, signaling contraction in the manufacturing sector as well.

The Flash Services PMI came in at 46.1 points below 48.0 estimates confirming further contraction. The currency pair jumped higher even if the US Durable Goods Orders, Core Durable Goods Orders, New Home Sales, and Revised UoM Consumer Sentiment came in better than expected.

On the other hand, the Eurozone and German manufacturing and services data came in better than expected. However, the sectors remain in contraction.

Fundamentally, the US Dollar took a hit also from the FOMC Meeting Minutes. As you already know, the Federal Reserve could deliver only a 50 bps hike in the next monetary policy meeting. Today, the German Ifo Business Climate and the ECB Monetary Policy Meeting Accounts could have a mild impact. The US banks will be closed in observance of Thanksgiving Day.

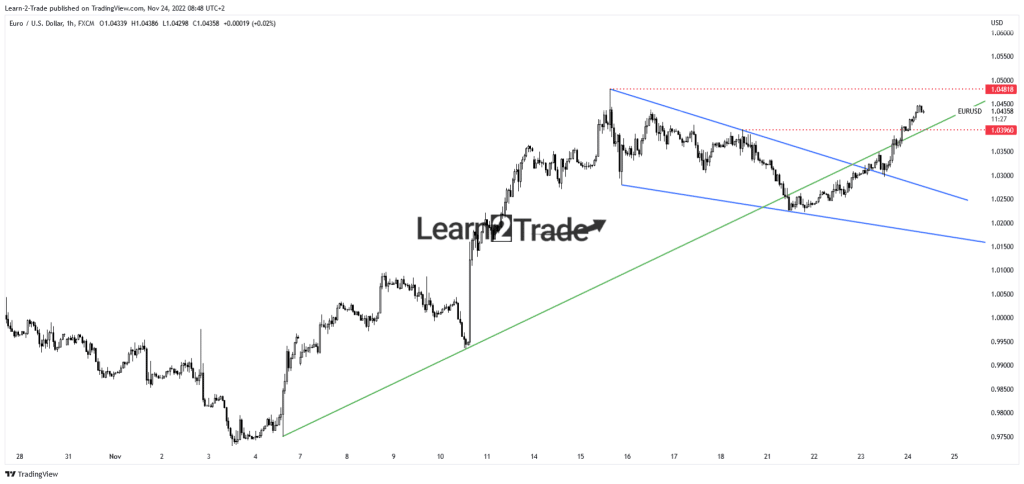

EUR/USD price technical analysis: Bullish bias

From the technical point of view, the EUR/USD pair escaped from the minor Falling Wedge pattern. Now it has passed above the 1.0396 resistance and beyond the up trendline. Failing to stay below the broken up trendline signaled that the retreat had ended and that the bulls could take control again.

–Are you interested in learning more about making money with forex? Check our detailed guide-

The higher high of 1.0481 represents an upside obstacle. A new higher high, registering a valid breakout through this level, activates further growth. Only false breakouts above this upside obstacle, cropping below the uptrend line, and under 1.0396 could announce a new sell-off. Technically, after its strong growth, a minor retreat is natural. It could test the near-term support levels before jumping higher.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.