The EUR/USD price jumped as high as 1.1830 today, where it has found strong resistance. Now it is trading lower at 1.1786 just above 1.1781 static support. It has gained after the ECB Monetary Policy Statement and after the Main Refinancing Rate publication.

–Are you interested to learn more about forex options trading? Check our detailed guide-

As you already know, the European Central Bank left its interest rate and the asset purchase program unchanged in today’s meeting. The interest rate could remain at the current levels or lower until inflation reaches 2%. The US Dollar dropped after the unemployment claims release. The indicator was reported higher at 419K versus 350K expected.

Euro is still weak as the Euro-zone Consumer Confidence dropped further from -3 to -4 points, even if the analysts have expected the indicator to remain steady. On the other hand, the Greenback has managed to gain again in the last hours even if the US existing home sales and the CB leading index failed to meet expectations.

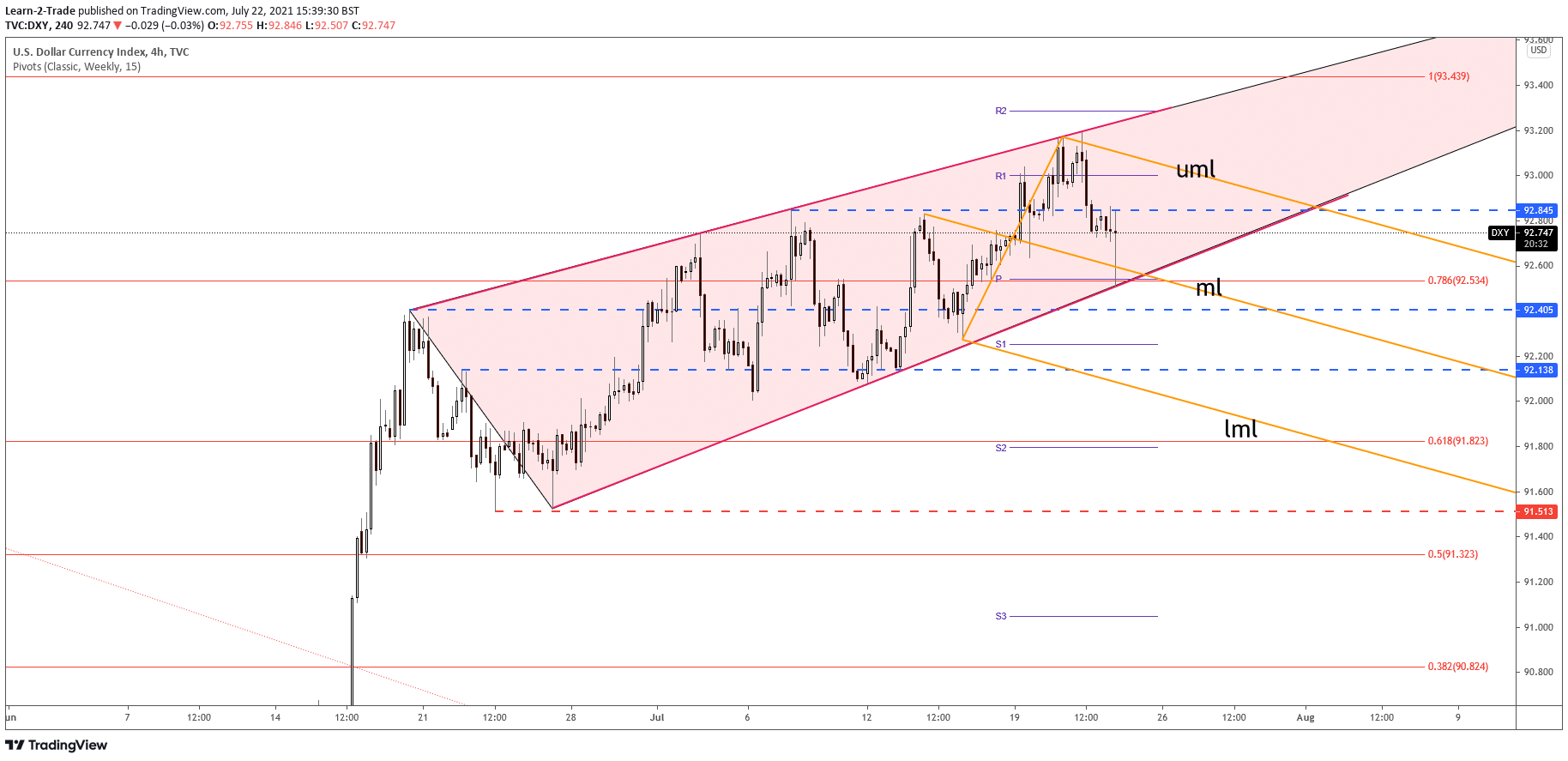

DXY price technical analysis

The DXY dropped and retested the up trendline, rising wedge support, and now is located at 92.77 level higher versus 92.50 today’s low. Additionally, it has registered only a false breakdown with great separation through the descending pitchfork’s median line (ml), signaling strong bullish pressure.

–Are you interested to learn about forex robots? Check our detailed guide-

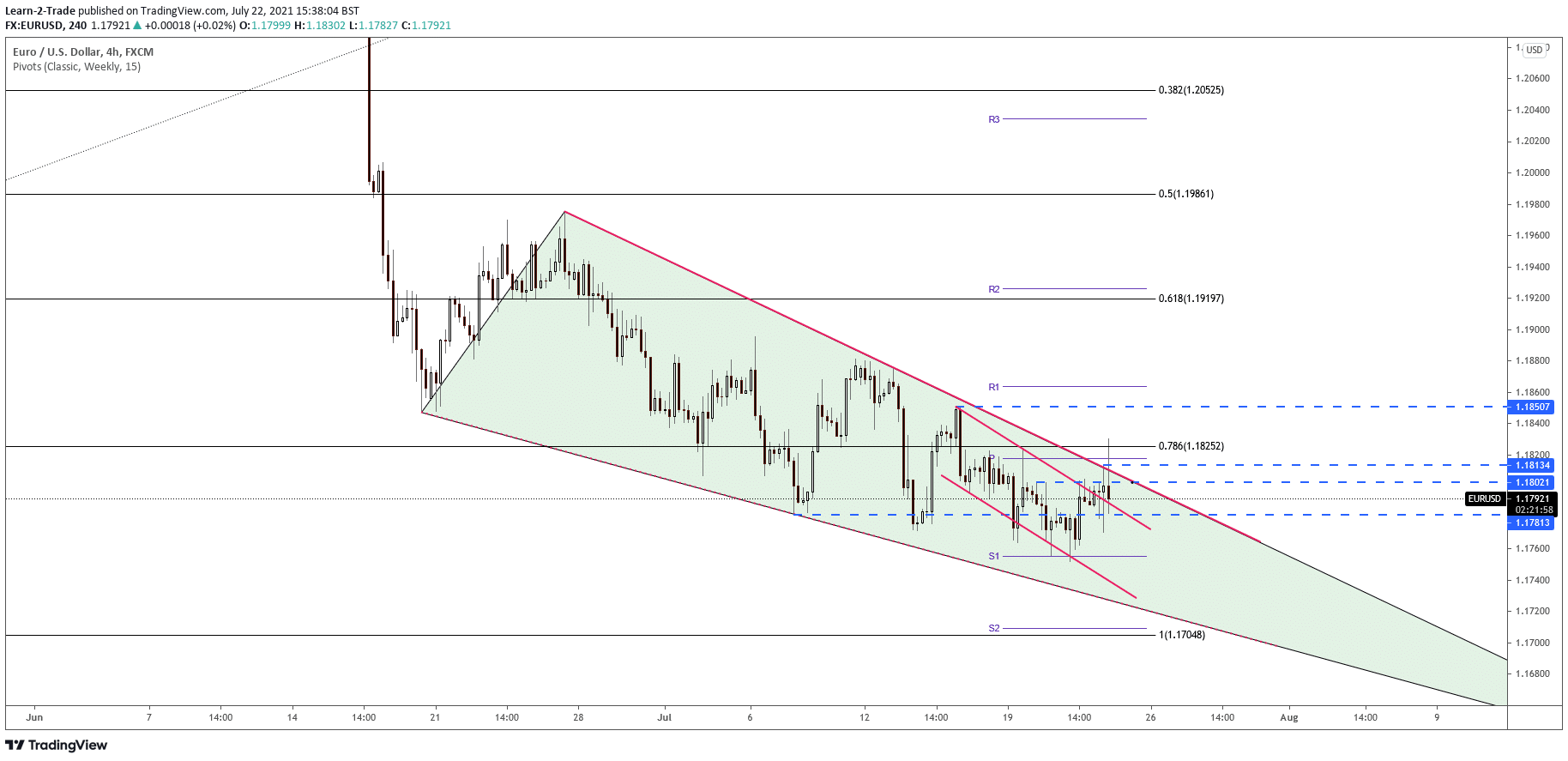

EUR/USD price technical analysis

DXY’s rebound forced the EUR/USD to drop far below the falling wedge resistance. As a result, it’s challenging the former down trendline and the 1.1781 level. Closing this candle around these levels and registering a false breakout with great separation could indicate strong selling pressure.

As you already know from my previous analysis, only a valid breakout from this pattern activates an upwards movement. We cannot exclude a decline towards the S1 (1.1755) if it closes under 1.1781.

It’s hard to believe that the EUR/USD pair could make an upside breakout soon. Most likely, it will drop deeper. However, I believe that only better than expected Eurozone data reported tomorrow and poor US figures could lift the pair again.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.