- The EUR/USD pair could return higher if the DXY drops again.

- The retreat was somehow expected after its strong rally.

- The price action signaled exhausted sellers. That’s why the rebound was natural.

The EUR/USD price dropped in the short term after reaching the 1.0601 level amid DXY’s rebound. As you already know, the Dollar Index plunged after the FOMC, signaling that it was overbought even if the FED raised the Federal Funds Rate by 75-bps in the June meeting.

-Are you interested in learning about forex tips? Click here for details-

Technically, the currency pair turned to the upside after failing to reach 1.0348 former low. The EUR/USD pair could jump higher if the DXY comes back down. The price could test the immediate downside obstacles before trying to resume its upside.

Fundamentally, the Eurozone Final CPI rose by 8.1%, matching expectations, while Final Core CPI surged by 3.8%, as expected. In addition, the Italian Trade Balance came in worse than expected. The US Unemployment Claims, Building Permits, Housing Starts, and the Philly Fed Manufacturing Index came in worse than expected yesterday.

Later today, Fed Chair Powell Speaks could bring more volatility. Industrial Production is expected to report a 0.4% in May versus 1.1% growth in April. The Capacity Utilization Rate could be reported at 79.2%, while the CB Leading Index may register a 0.4% drop.

EUR/USD price technical analysis: Rebound

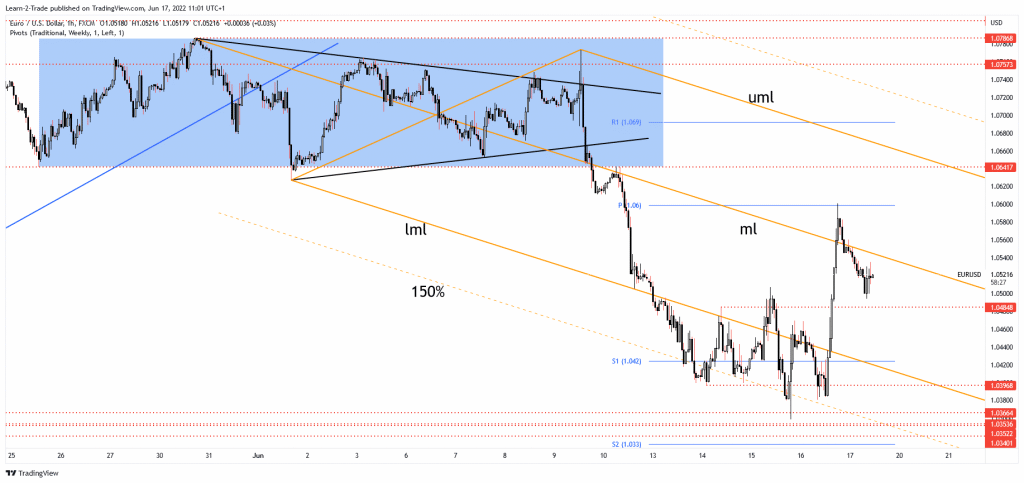

From the technical point of view, the EUR/USD pair failed to stabilize below 1.0396 static support. The false breakdowns signaled exhausted sellers. The 1.0484 level represented a static resistance level. The aggressive breakout signaled strong growth in buyers in the short term. As you can see on the 1-hour chart, the EUR/USD pair found resistance at the weekly pivot point of 1.0600. Now, it has retreated a little, and it was almost to retest the 1.0484 key level.

-Are you interested in learning about the forex basics? Click here for details-

The median line (ml) represents a dynamic resistance. Staying above 1.0484 and taking out the dynamic resistance may signal potential growth towards the weekly pivot point again. Dropping and stabilizing below the 1.0484 static support may open the door for more declines towards the lower median line (LML) and down to 1.0396 support.

A larger upside movement could be activated only by a new higher high if the rate jumps and closes above 1.0601.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money