- The bias remains bearish as long as it stays under the near-term resistance levels.

- Making a valid breakout through the confluence area may signal further growth.

- In the short term, it could continue to move sideways.

The EUR/USD price rallied as the Dollar Index dropped in the last hour. The price moves sideways in the short term. The pair is trading at 1.0589 at the time of writing. DXY’s sell-off could force the pair to approach and reach new highs. Technically, it stands under strong upside obstacles. That’s why the bias remains bearish.

–Are you interested in learning more about STP brokers? Check our detailed guide-

After its strong drop, a temporary rebound is natural, but we need confirmation. As you already know, the USD is strongly bullish as the Federal Reserve increased the Federal Funds Rate in the last two monetary policy meetings.

Furthermore, the FED is expected to hike rates in the next meeting as the high inflationary pressure. Still, in the short term, the Dollar Index could be overbought. This is because the last rate hike was priced in.

On Friday, the US economic data came in mixed. Unfortunately for the USD, the Unemployment Rate remained at 3.6%, above 3.5% expected, while the Average Hourly Earnings rose by 0.3% in April, less than 0.4% estimated. On the other hand, the USD received a helping hand from the Non-Farm Employment Change came in at 428K above 390K estimates.

Today, the US Final Wholesale Inventories reported 2.3% growth matching expectations, while the Euro-zone Sentix Investor Confidence and the French Trade Balance came in worse than expected.

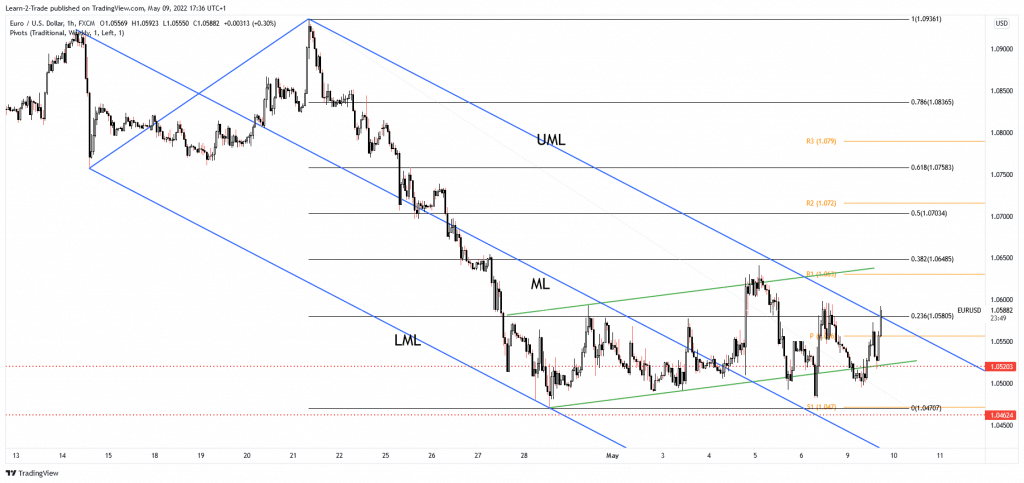

EUR/USD price technical analysis: Rangebound behavior

The EUR/USD pair retested the 1.0520 and the up trendline, and now it challenges the confluence area formed at the intersection between the 23.6% (1.0580) and the upper median line (UML).

–Are you interested in learning more about making money with forex? Check our detailed guide-

A valid breakout through this confluence area may signal further growth. Unfortunately, the price action failed to confirm a larger drop after registering only false breakdowns below the up trendline and through the 1.0500 psychological level.

Technically, as long as it stays under the upper median line (UML), the price could drop anytime again. A false breakout through the confluence area could announce a new sell-off. This scenario could take shape if the Dollar Index resumes its growth.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money