- The EUR/USD pair maintains a bearish bias despite temporary rebounds.

- Failing to reach and retest the downtrend line signaled downside pressure.

- DXY’s upside continuation should force the USD to appreciate.

The EUR/USD price was trading at 0.9666 at the time of writing, far above today’s low of 0.9554. After its massive sell-off, a temporary rebound is natural.

-Are you looking for automated trading? Check our detailed guide-

The price extended its sell-off in the early morning after the US Flash Services PMI came in at 49.2 points versus 45.5 expected, while Flash Manufacturing PMI was reported at 51.8 points beating the 51.0 forecasts on Friday.

Today, the German Ifo Business Climate came in at 84.3 points below 86.9 points expected and compared to 88.6 in the previous reporting period. Later, ECB President Lagarde Speaks could bring high action.

Tomorrow, the US CB Consumer Confidence, New Home Sales, Richmond Manufacturing Index, Durable Goods Orders, Core Durable Goods Orders, and the German Retail Sales could move the rate.

Dollar Index price technical analysis: Corrective downside

The Dollar Index climbed as high as 114.52, where it found resistance. It has been reiterated in the short term, but the correction ended around 113.22 static support (resistance turned into support).

Now, the index has jumped above 113.60, the former low, representing an upside obstacle. Stabilizing above it may signal that the correction ended and that the DXY could return higher. DXY’s upside continuation could force the greenback to appreciate versus the other currencies.

EUR/USD price technical analysis: Bounce back

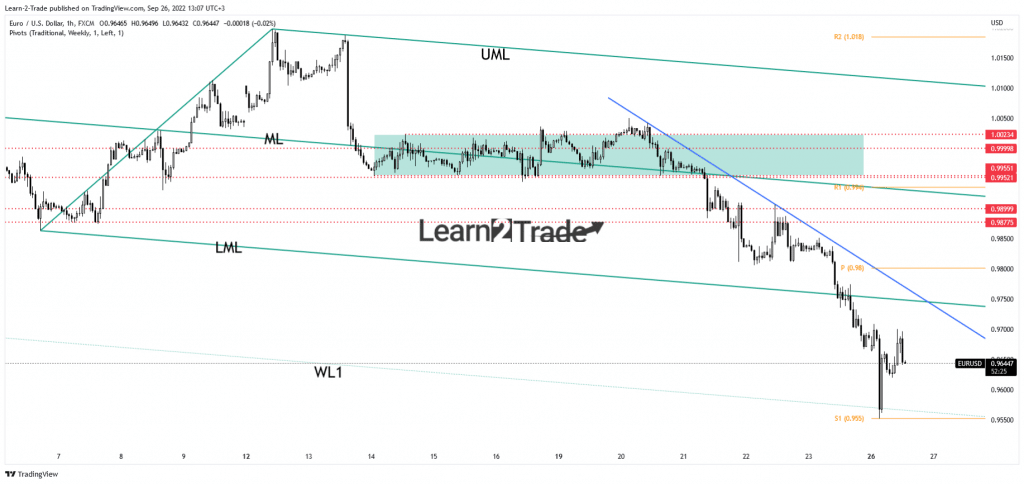

As you can see on the hourly chart, the EUR/USD found support on the weekly S1 (0.9550) and the descending pitchfork’s first warning line (wl1). It has rebounded but found resistance at the 0.97 psychological level, and now it has turned to the downside again.

-If you are interested in forex day trading then read our guide to getting started-

The bias remains bearish despite temporary rebounds. In the short term, the rate could try to test and retest the near-term resistance levels before going down. The descending trendline and the lower median line (LML) represent near-term upside obstacles. Failing to reach and retest these resistance levels signals strong downside pressure. After their strong rebound, the EUR/USD pair could return to the near-term downside obstacles.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.