- USD pullback drives EUR/USD lower amid ECB-induced decline amid the first positive week in five.

- The US Senate passed a $14 billion bill for Ukraine and $1.5 trillion to avoid a government shutdown.

- Inflation in the US drove DXY’s growth, as the ECB tried to follow the Fed.

- Meeting of the UN Security Council At the request of Russia, the US Bureau of Consumer Sentiment in Michigan is examining a fresh approach.

The EUR/USD price hit 1.1000, up 0.15% intraday in the middle of Friday’s Asian session due to the ECB’s actions.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

There could be a correlation between the pair’s recent moves and market confusion over key risk catalysts as well as the dollar’s weakening. However, the major currency pair is still in the process of breaking its four-week losing streak.

Risk catalysts

As a result of the United States Senate’s passage of a $13.6 billion aid package for Ukraine and a $1.5 trillion bill to prevent a shutdown, Western aid may increase to Kyiv, putting pressure on the EUR/USD exchange rate today at the United Nations (UN) Security Council meeting. In the meantime, fears of a resurgence of the Coronavirus in China and a Russian invasion of Ukraine pressed prices downward. Furthermore, the pair’s weakness could raise hopes for a faster rate hike by the Fed due to US inflation data released the previous day.

In contrast, uncertainty about the Russian military’s position in Ukraine and the absence of significant data/events in Asia appear to limit EUR/USD’s decline. Market sentiment initially faltered after Russian military reports alleging an attack on an experimental nuclear reactor at the Kharkiv Institute. However, news of a lack of negatives allayed fears. The optimists were also encouraged by reports that Moscow’s forces were dissipating and were possibly withdrawing before US satellite company Maxar reported more troops were being moved.

ECB’s announcement

In its announcement on faster quantitative tightening (QT) the day before, the European Central Bank (ECB) cited inflation concerns. Meanwhile, euro traders revised their inflation expectations upwards as dovish growth forecasts drove the euro down. However, according to Reuters, the market sentiment briefly turned negative after the ECB affirmed the possibility of a rate hike until the end of 2022 due to rising inflation outweighs fears about the impact of a Russian invasion of Ukraine.

At press time, futures on the S&P 500 are down 0.5% on the day, while 10-year US Treasury yields are down 4.4 basis points (bps) to 1.965%. In addition, the US Dollar Index (DXY) remains dovish around 98.50 but is determined to break the previous four-week uptrend.

Upbeat US CPI

On the other hand, risk aversion has helped drag the US dollar down the previous day despite the US CPI’s fresh 40-year high of 7.9% y/y. CME FedWatch shows a 94% chance of a 50 basis point rate hike by March.

In addition, the UN meeting and news from Ukraine may maintain their lead, while US-Michigan consumer sentiment for March, expected to hit 61.3 as opposed to 62.8, will also be important for informing the new Follow the direction of the EUR/USD.

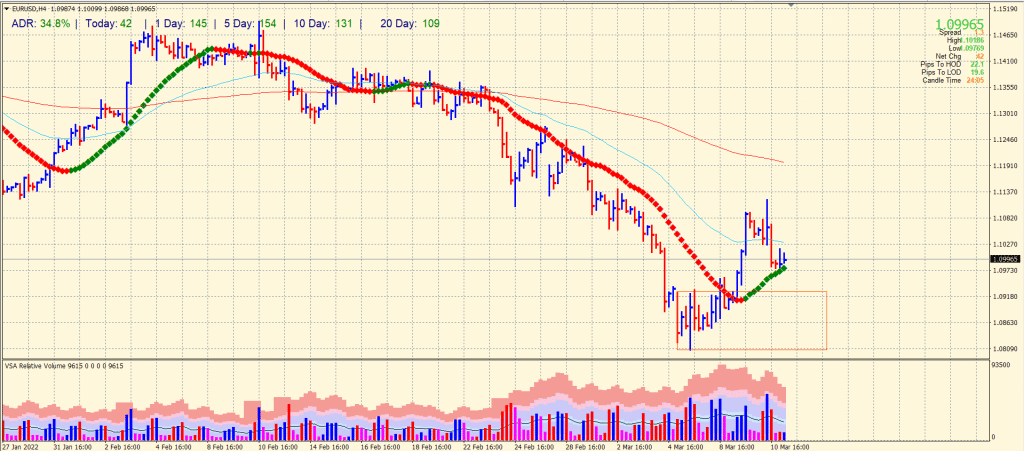

EUR/USD price technical analysis: Neutral bias

The EUR/USD price twice attempted to break the 1.1100 level but failed. As a result, the price turned negative below the 50-period SMA on the 4-hour chart. However, the 20-period SMA provided some respite to the buyers and the pair has been able to recover slightly back above the 1.1000 key mark.

The volume data is somewhat bearish, showing a probability of testing yesterday’s lows around 1.0975 ahead of 1.0950 and then 1.0900. On the upside, any subsequent move may test the 1.1100 area again.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

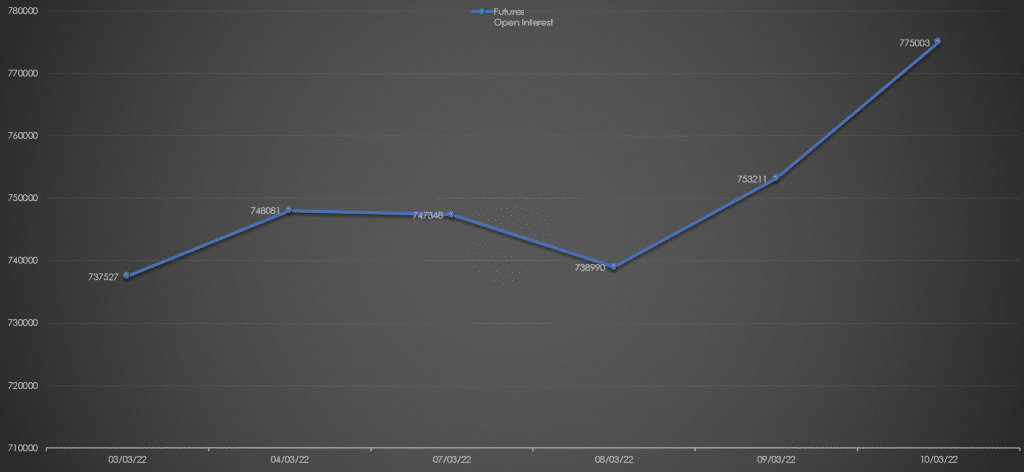

EUR/USD price analysis via daily open interest

On Thursday, the daily close price was lower than the previous day’s close price. Meanwhile, the open interest rose a great deal. It shows that the active sellers have entered the market with significant volume.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money