- After its massive drop, a rebound was natural.

- The US retail sales data should move the price today.

- It could test and retest the resistance levels before going down again.

The EUR/USD price rallied in the last hours. The pair is now trading at 1.0896, far above yesterday’s low of 1.0844. After its massive drop, a rebound was natural in the short term.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

Yesterday, the German WPI and the Eurozone Industrial Production came in worse than expected. Still, the currency pair was lifted by the US Empire State Manufacturing Index, which dropped from 10.8 points to -31.8 points, far below the -3.7 points estimated.

Today, the Eurozone ZEW Economic Sentiment came in at -9.4 points versus -1.0 points expected, compared to 6.4 in the previous reporting period.

The German ZEW Economic Sentiment dropped to -10.7 points from 4.1 points. Furthermore, the Eurozone Trade Balance and Flash Employment Change came in better than expected, while Flash GDP aligned with expectations. The Canadian inflation figures should also have a big impact on the USD.

Still, the US retail sales data release could represent the day’s most important event. The Retail Sales indicator is expected to report a 0.8% growth in April, while Core Retail Sales could increase by 0.5% after the 0.8% drop in March.

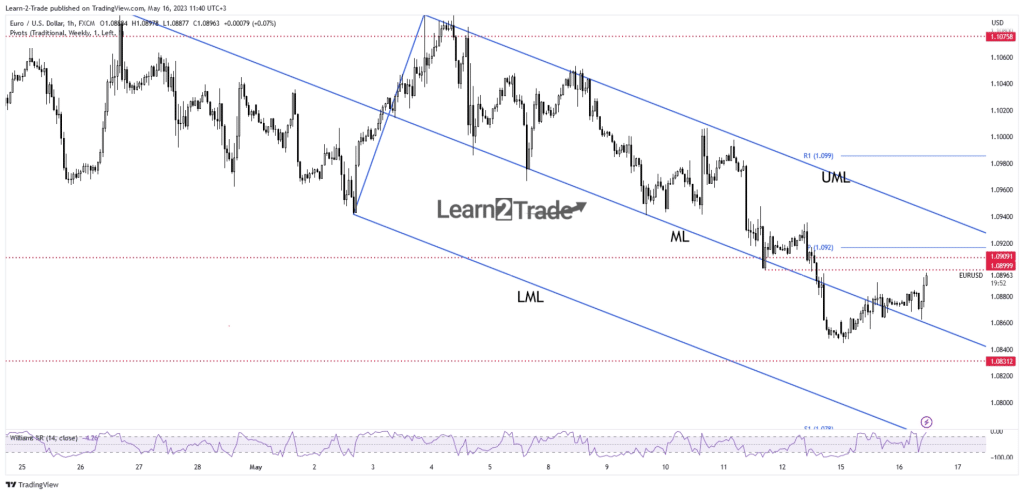

EUR/USD price technical analysis: Correction after the downfall

From the technical point of view, the EUR/USD pair failed to test the 1.0831 support level. Hence, buyers seem to dominate the market mildly.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

As you can see on the hourly chart, the price registered a valid breakout through the median line (ML). Now it challenges the 1.0899 static resistance. Failing to stay below the median line (ML) announced exhausted sellers, so a rebound was natural.

Technically, the pair could return to test the immediate resistance levels before going down again. The 1.0909, the pivot point 1.0920, and the upper median line (UML) represent upside obstacles.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.