- EUR/USD is trading higher as the dollar weakens due to poor economic data.

- The war in Ukraine continues to push the price of commodities higher, increasing inflation worries.

- Bulls are looking to push EUR/USD to 1.0800 on the charts.

The EUR/USD price closed Thursday higher on a bullish candle as investors reacted to the poor GDP data released by the US. These gains extended to Friday morning as the pair traded above yesterday’s close at around 1.0743.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

The US faces economic slowdown fears, affecting EUR/USD. On Thursday, investors were disappointed by the lower-than-expected GDP at -1.5%, which came lower than the previous -1.4%. This slowdown saw the dollar weakening and the EUR/USD moving higher.

The pair is currently trading at around 1.0750 as bulls wait for US PCE inflation data later. It is possible that, in the short term, at least, the bull market has returned owing to the ECB’s bid to see the euro stronger again.

Investors will be paying attention to the war in Ukraine, which affects financial markets worldwide. New developments are impacting prices and pushing inflation higher. The ECB has warned that vulnerabilities may increase, brought on by uncertainties about the war and changing expectations of policy normalization.

Commodities and energy prices remain elevated, with crude oil (CL) futures trading at around 113.88 Friday morning. If the growth outlook weakens, these assets are at risk of higher prices, further pushing higher inflation. These price pressures are bound to affect currencies like the EUR/USD as monetary policies become tighter, pushing the pair higher or lower in the future.

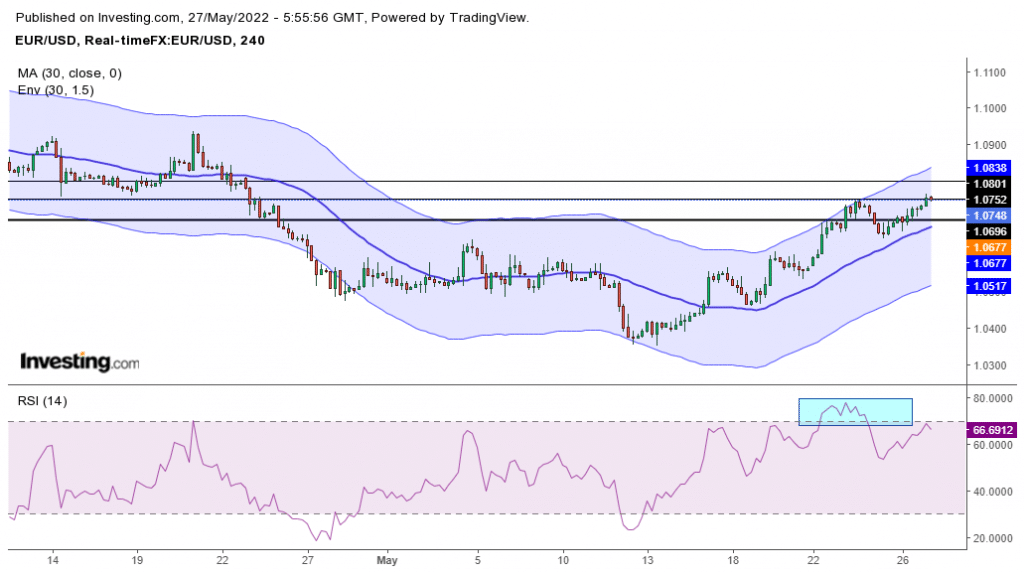

EUR/USD price technical analysis: Bulls ready to test 1.0800

The 4-hour chart shows the return of bulls in the market. Are they here to stay or just for a short while? The price is consistently trading above the 30-SMA and making higher highs and lows. The RSI has also started to get to the overbought region, showing bullish momentum.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

The price is trading above 1.0700 and experiencing some resistance at the 1.0750 level. Therefore, the bias here is bullish and will stay that way if the price stays above the 30-SMA, and the RSI does not slide back to the oversold region. The next level for price now is 1.0800.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money