- A new higher high could activate a more significant swing higher.

- The US data could be decisive later today.

- The EUR/USD pair could continue to move sideways in the short term.

The EUR/USD price dropped after reaching the 1.0078 level. Now, the pair is trading at 1.0018. It looks choppy in the short term.

-Are you interested in learning about the forex indicators? Click here for details-

The price rebounded as the Dollar Index was in a temporary corrective phase. DXY maintains a bullish bias, so further growth should force the USD to appreciate versus its rivals. Still, the index could come back in the short term to test the near-term downside obstacles before jumping higher. Fundamentally, the DXY maintains a bullish bias as the FED is expected to increase the Federal Funds Rate by 50bps in September.

Yesterday, the USD hit the ADP Non-Farm Employment Change and the Chicago PMI, which reported worse than expected data. Earlier, German Retail Sales rose by 1.9% versus a 0.1% drop expected. Unfortunately for the Euro, the Euro-zone Final Manufacturing PMI and German Final Manufacturing PMI reported worse than expected data. Later, the Euro-zone Unemployment Rate is expected to be at 6.6%.

The day’s most important event is represented by the US ISM Manufacturing PMI, which dropped from 52.8 points to 52.1 points. In addition, the Final Manufacturing PMI, Construction Spending, ISM Manufacturing Prices, and the Wards Total Vehicle Sales could provide stimulus to the market.

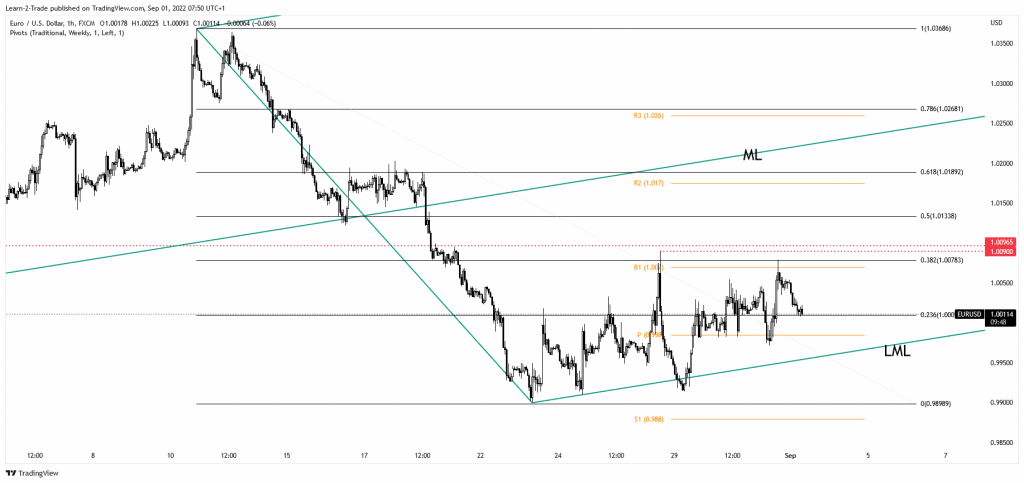

EUR/USD price technical analysis: Correcting higher

As you can see on the hourly chart, the EUR/USD pair found resistance at 38.2% (1.0078), and now it has retested the 23.6% (1.0009). As long as it stays above this level and parity, the price could try to come back higher, at least towards 38.2%.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

The 1.0090 and 1.0096 levels represent upside obstacles. Only a valid breakout through these resistance levels can activate a meaningful recovery. The price tested the lower median line (LML), representing dynamic support. A higher high could bring new long opportunities as the EUR/USD pair could be attracted by the median line (ML).

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.