- EUR/USD breaks its four-day uptrend and pulls back from an eight-day high.

- The ECB hawks will support rate hikes in 2022 due to high inflation and low unemployment.

- Neither the monetary policy measures nor the economic forecasts are expected to change the bloc’s central bank.

The EUR/USD price bulls pause around 1.1300 after a four-day uptrend to refresh a weekly high amid pre-ECB sentiment.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

Despite a strong economy in the United States, the major currency pair has recently welcomed the US dollar weakness. Nevertheless, the cautious sentiment ahead of the major weekly data/events appears to challenge the EUR/USD buyers on Thursday.

As inflation fears have been highlighted by all three US President Biden Fed Board nominees, they challenge risk appetite and drag down the EUR/USD exchange rate, despite upbeat eurozone HICP data that soared quotes the previous day. Furthermore, in January, ADP US employment changed negatively: -301k vs. +207k expected. In addition, the recent comments from US Treasury Secretary Janet Yellen suggest that the temporary definition of inflation is incorrect, re-igniting concerns about reflation and impacted listings.

The 10-year Treasury yields dropped about 1.77% this week, while the US and European stock futures declined. Despite the first loss in three weeks, the bad sentiment strengthens the US Dollar Index (DXY), allowing the dollar indicator to stabilize at 96.00.

In spite of this, HICP y/y headlines indicate a record-high inflation rate for the eurozone and a record-low unemployment rate for the bloc, which allows the European Central Bank (ECB) to pass on a hawkish bias. Although US and eurozone fundamentals diverge and different developments in different countries in the region, ECB President Christine Lagarde may be able to voice cautious optimism again and allow EUR/USD rates to fall even further.

Traders will be busy with ECB action and the release of fourth-quarter US labor productivity and unit labor cost data, as well as January’s ISM services PMI and December’s factory orders.

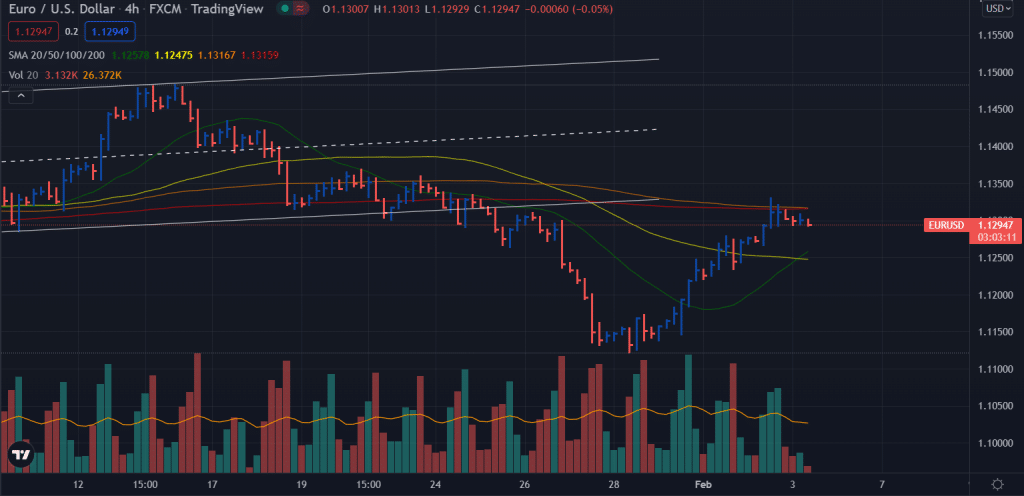

EUR/USD price analysis: Bears eying 1.1260

The EUR/USD price could not hold on to the gains above 200-period SMA on the 4-hour chart. Moreover, the pair also hit the stiff resistance level at 1.1330 and bounced back below the 1.1300 handle. The next important level on the downside lies at 1.1260, a horizontal level, and 20-period and 50-period SMAs also coincide at the same price. The volume data supports the bearish bias as the rejection bar is an up bar that closed in the middle with a very high volume.

–Are you interested to learn more about Islamic forex brokers?

Alternatively, the pair may see an upside momentum if it breaks the 1.1330 resistance. The next targets for the bulls will be 1.1385 and 1.1420.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.