- The EUR/USD pair maintains a bearish bias despite temporary rebounds.

- Stabilizing below the lower median line (LML) may activate more declines.

- Only a valid breakout above 1.0944 – 1.0960 could announce an upwards movement.

The EUR/USD price rallied in the short term after reaching lows at the 1.0864 level. The price turned to the upside as the Dollar Index failed to resume its growth. After its amazing rally, the DXY could retreat a little before extending its upward movement.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

Also, the currency pair could come back to test the immediate resistance levels before dropping towards fresh lows. The pair maintains a bearish bias, but a temporary rebound is somehow expected after its massive drop. Despite hawkish FOMC Meeting Minutes, the USD could lose ground in the short term. It seems that the Dollar Index is overbought.

Fundamentally, the Eurozone economic data came in mixed today. The German Industrial Production registered a 0.2% growth versus 0.1% expected after a 1.4%% growth in the previous reporting period. In addition, the Retail Sales disappointed as the indicator reported a 0.3% growth versus 0.6% expected.

The USD is sluggish in the short term, even though the US Unemployment Claims indicator was reported at 166K in the last week, far below 201K expected and compared to 171K in the previous reporting period. Later, Consumer Credit and the Treasury Sec Yellen Speaks could bring some volatility.

EUR/USD price technical analysis: False breakdown

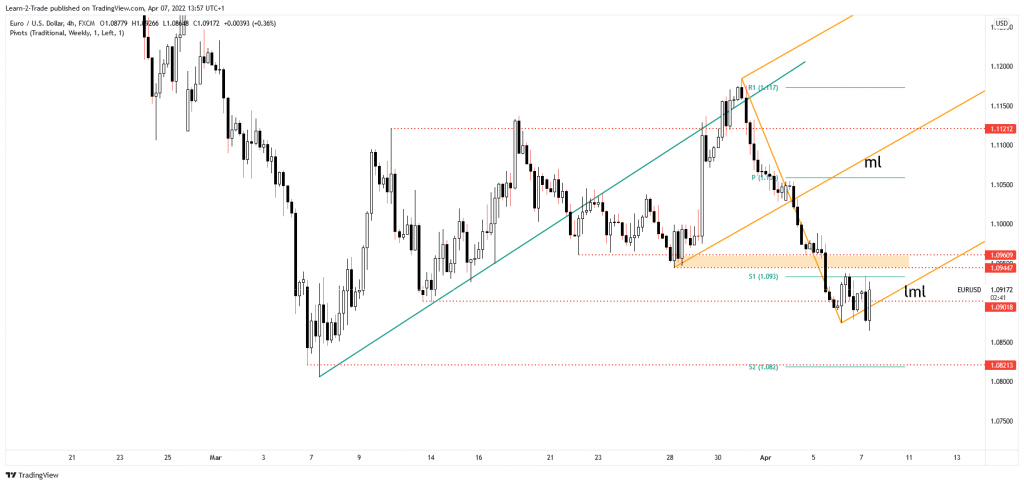

As you can see on the 4-hour chart, the EUR/USD pair failed to stabilize below 1.0874 former low, and below the ascending pitchfork’s lower median line (LML), signaling that the sellers are exhausted. A bearish engulfing candle, registering only a false breakdown, may signal that the downside movement could be over.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

Still, it’s premature to discuss a new leg higher if it stays under the weekly S1 (1.0930) and below the 1.0944 – 1.0960 area. In my opinion, only a valid breakout above this area may signal an upwards movement.

Further drop and downside continuation could be validated if the rate drops and stabilizes below the ascending pitchfork’s lower median line (LML). Also, dropping and staying below 1.0900 psychological level may activate more declines.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money