- EURUSD is consolidating around 1.0580

- Is the dollar still a safe haven?

- ECB is on the path to raising interest rates.

As of Friday morning in Europe, the EUR/USD price was hovering around 1.0580 after experiencing a bullish day yesterday. The debate among investors is whether prices can get to parity. Is it possible for the price to get to 1 after nearly 20 years?

–Are you interested in learning more about forex robots? Check our detailed guide-

Traditionally, the dollar was seen as a safe haven during harsh economic conditions. However, the current global crises like inflation and the war in Ukraine have pushed investors to buy more dollars, thereby raising the price. This, in turn, has seen the euro weakening to a record low around 1.0350.

However, this morning, the story has changed as investors are running for treasury bonds. The dollar is expected to fall after a 14-week surge and might not be considered safe anymore.

Divergence in monetary policy among central banks has also caused the tightening of the gap between the two currencies. While the Federal Reserve is aggressively raising interest rates to try and control inflation running at a 40-year high, the European Central Bank is yet to raise interest rates.

This is even though inflation is at a record high in the Eurozone. However, a rate hike by the ECB might come soon as they have become more hawkish recently. On Monday, ECB policymaker Francois Villeroy de Galhau noted that price stability in the bloc might be affected by excessive euro weakness. This could further push prices higher and drive inflation to new highs.

EUR/USD key events today

Philip R. Lane, a member of the Executive Board of the European Central Bank, will be speaking later in the day. His speeches are often known to signal the possible direction of monetary policy.

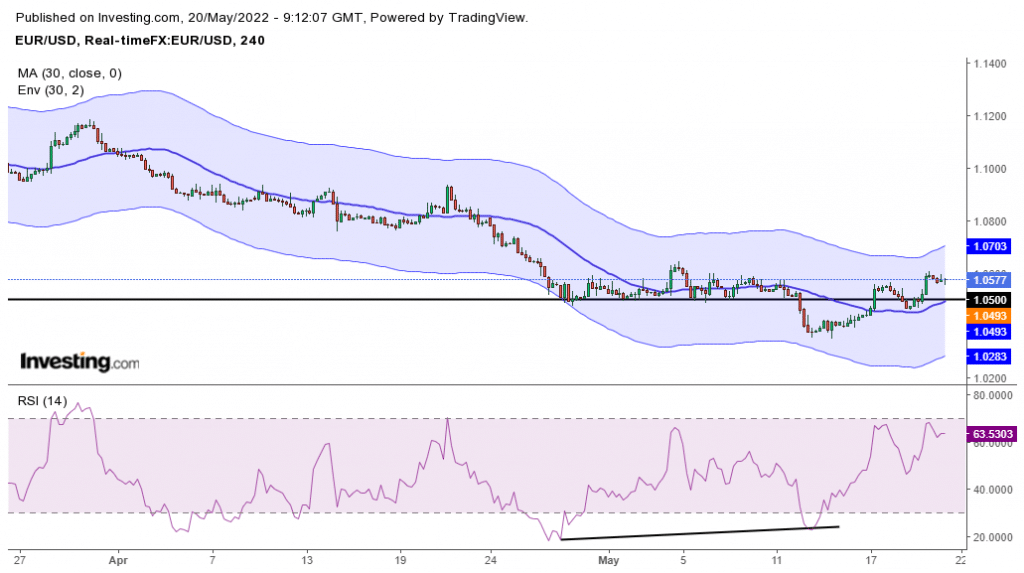

EUR/USD price technical analysis: Bulls fighting to take out 1.0600

The 4-hour chart shows a possible reversal as prices are trading above the 30-SMA. However, RSI would have to exceed 70 and get overbought to confirm this reversal. That would show that the bulls are back and they are strong.

–Are you interested in learning more about South African forex brokers? Check our detailed guide-

The RSI bullish divergence also supports a reversal to the upside. The divergence shows a possible weakening of the bearish momentum. This could be because the price is at the critical psychological level of 1.0500. If we see lower highs, prices would need to break and stay below this level.

At the moment, the best position would be to wait and see which side wins. Will the bulls be strong enough to keep prices going up, or will the bears succeed in breaking through the 1.05 critical level?

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money