- EUR/USD soars above 1.05 in response to ECB’s Knot.

- ECB looks to normalize policy.

- A 50-bps rate hike should not be ruled out if data in the next few months suggest rising inflation.

The EUR/USD price broke above the 1.0500 level on Tuesday as the ECB provided some support and the US dollar retreated. However, the rise can be short-lived as the Fed’s rate hike plan is hovering around.

–Are you interested in learning more about forex robots? Check our detailed guide-

A hawkish condition is still very possible, but a 50-bps rate movement seems too much if the aim is to maintain a balance. This will mark the first rate hike by the ECB in more than a decade. That’s enough to tell you how strict their policy settings are, so pardon me if I wasn’t impactful enough to provide a striking mental shift.

The ECB does have its fair share of seeking dramatic moments. Still, we have to consider that Knot is one of the more hawkish members, and for a central bank that hasn’t raised interest rates in more than a decade, it’s hard to buy a big change in mentality suddenly from dovish majority to hawkish.

Nonetheless, money markets now expect a rate hike of around 105 bps by the end of the year by the ECB. That compares with about 95 bps yesterday.

EUR/USD key events to watch

Moreover, on Tuesday, there will be an ECB’s President Lagarde and FED’s Chairman Powell speech event which are successively very close to their implementation, which can have an impact on very fast movements, so it is necessary to watch out for between 1700 and 1900 UTC and tighten your margin management for lowering the risk.

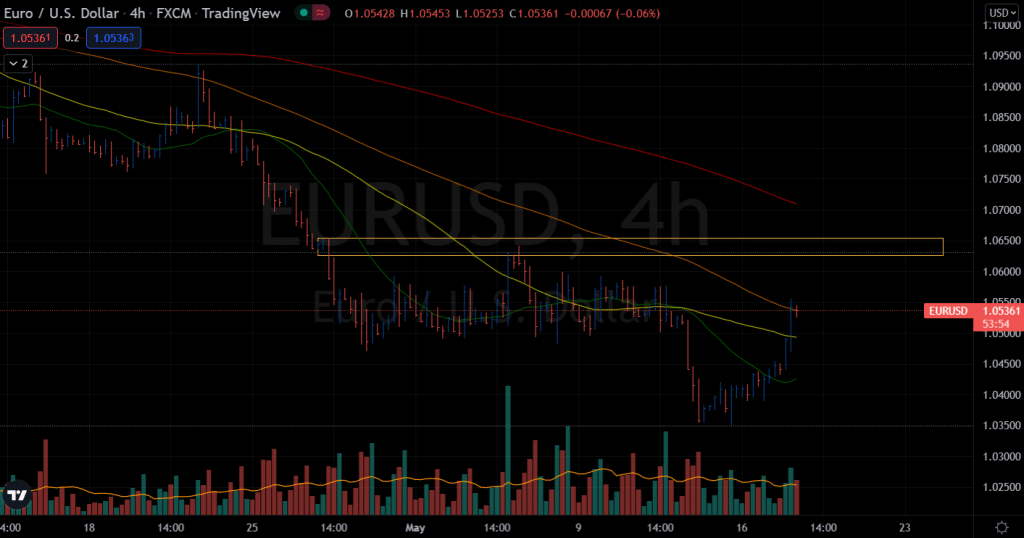

EUR/USD price technical analysis: Bulls eying supply zone

From a technical viewpoint, the EUR/USD pair saw a bounce from the support around 1.0400. However, with the broader risk sentiment also faring better today, the dollar today appears to be experiencing a slight pullback against the other majors.

–Are you interested in learning more about South African forex brokers? Check our detailed guide-

But EUR/USD got a jolt from 1.0480 to 1.0520 on the back of Knot’s statement here. Of course, a July rate hike is a sure thing, but he floated the idea of a potential 50-bps rate hike, which got the market a little excited.

The EUR/USD price has now breached the 200-period SMA at 1.0494 and is trying to hold above 1.0500, allowing the buyers to build some breathing room after their unrelenting push lower since the start of the year. The region around 1.0530-1.0580 will offer some minor resistance next, which is a moment of accumulation that has been done for the past 2 weeks.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money