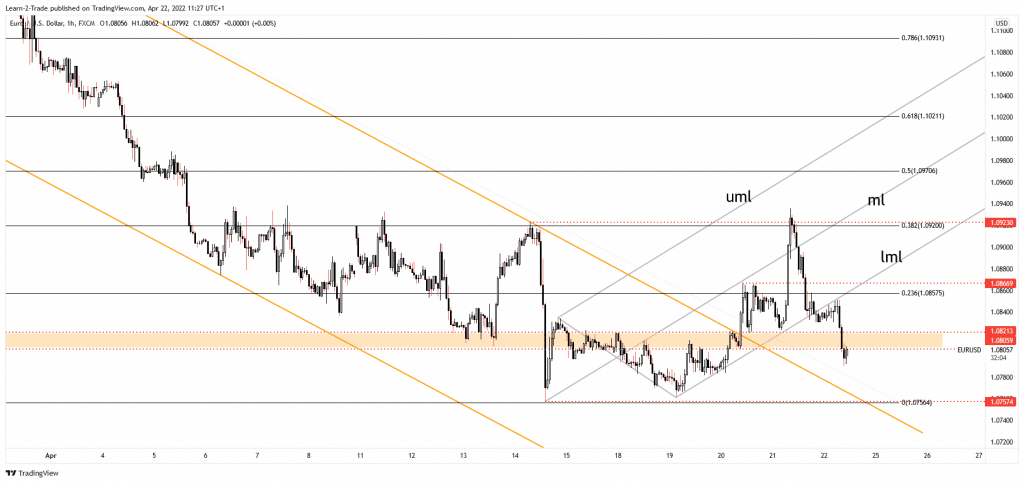

- The EUR/USD pair could drop deeper after failing to take out the 38.2% level.

- A minor rebound could bring new short opportunities.

- Only a bullish pattern on the 1.0757 could announce a new leg higher.

The EUR/USD price plunged after failing to remove the 1.0923 static resistance. The DXY ended its sell-off and now is almost reaching new highs. The greenback may keep dominating the currency market if the Dollar Index maintains its growth.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

The inflationary pressure is high. The FED is expected to increase the Federal Funds Rate by 0.50% in the May meeting. Technically, the pair tried to rebound in the short term. However, a larger growth was invalidated. Therefore, the price could drop deeper anytime.

Today, the fundamentals could drive the rate. For example, the German Flash Services PMI came in at 57.9 points above 55.4 estimates compared to 56.1 in the previous reporting period signaling further expansion.

In contrast, the German Flash Manufacturing PMI dropped from 56.9 to 54.1, below 54.6 expected. In addition, the Euro-zone and French Flash Services PMI and Flash Manufacturing PMI reported better than expected data. Still, the downside pressure remains high despite some positive data.

Later, the US Flash Services PMI could remain steady at 58.0 points, but the Flash Services PMI could be reported at 58.1 points below 58.8 points in the previous reporting period. Also, the ECB President Lagarde’s Speaks could bring more volatility.

EUR/USD price technical analysis: Bears remain in charge

The EUR/USD pair is trapped between 1.0757 and 1.0923 levels in the short term. After its massive drop, we cannot exclude a minor rebound. Stabilizing below 1.0805 could signal more declines toward the 1.0757 major downside obstacle.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

After escaping from the down channel pattern, the pair was expected to resume its growth. Technically, 38.2% (1.0920) stopped the price, signaling that the rebound was over and that the sellers could take the lead again. 1.0757 stands as critical support.

A valid breakdown below this level, a new lower low could activate more declines. On the contrary, if this level holds, we can look for potential longs in the short term. I believe that a minor rebound after its massive drop could bring new short opportunities.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money