- The EUR/USD is hovering around a week high but remains moderate.

- The day before, Powell and the ECB policymakers helped buyers.

- World Bank forecasts and viral issues test immediate growth ahead of US CPI.

- Economic calendars also include the production of industrial goods in the eurozone.

Traders prepare for key US inflation data early Wednesday morning as EUR/USD price rallies. However, the major currency pair continues to hover around its weekly high of 1.1375 and has recovered 0.08% for the second day in a row.

–Are you interested to learn more about AI trading brokers? Check our detailed guide-

Bullish sentiment in the EUR/USD pair is fuelled by caution ahead of the important US consumer price index (CPI). The pessimistic yields on US Treasuries and the US dollar are encouraging buyers despite controversial comments from Fed Chairman Jerome Powell and ECB policymakers.

Market jitters over the Coronavirus and its economic impact challenged the EUR/USD pair’s upward momentum during a sluggish day.

The US Dollar Index (DXY) dipped daily by 0.35 percent the previous day after Fed Chairman Powell indicated a willingness to raise interest rates. Powell’s comments that the balance might rise “later this year” seemed to support the decline of 0.35%. However, Powell also predicted that the supply crisis would ease slightly and the impact of the Omicron variant would be short-lived. Today, the DXY hit a two-month low during the Asian session.

However, ECB President Christine Lagarde and a new member of the Board of Governors of the European Central Bank (ECB), and Bundesbank President Joachim Nagel supported the euro bulls yesterday. Despite Lagarde’s efforts to convince the markets of possible restrictive measures, Nagel argued that the spike in inflation in the euro area was not simply a temporary phenomenon. Phillip Lane, the chief economist at the ECB, noted in an interview that inflation will fall this year, limiting the upside potential of EUR/USD.

Additionally, the World Bank (WB) lowered its global GDP estimates for 2022 from 4.3% to 4.1% due to concerns about Coronavirus. According to the St. Louis Federal Reserve (FRED), the 10-year break-even inflation rate, which rose the most in just two months, might also pose a challenge for EUR/USD bulls.

In this context, US Treasury bond yields remain sluggish after the recent decline, but stocks cannot continue Wall Street’s rally at the moment.

While December’s consumer price index in the US, which is expected at 7.0% y/y compared with 6.8% previously, will dominate the development of the EUR/USD pair, November’s industrial production in the euro area is expected to improve by 0.6% y/y versus 3.3% earlier, which could provide direction for the pair immediately.

–Are you interested to learn more about Canada forex brokers? Check our detailed guide-

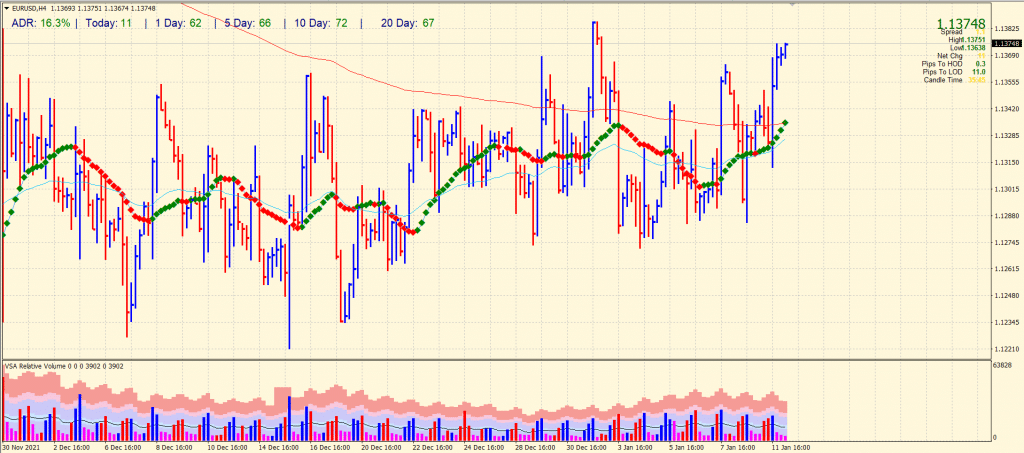

EUR/USD price technical analysis: Bulls shy of 1.1385

The EUR/USD price has jumped up but remains shy of strong resistance at 1.1385. The pair is well above the key SMAs on the 4-hour chart. However, the volume data does not support the recent up wave. Therefore, the bullish trend will only be considered after a clear breakout of the 1.1385 area.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.