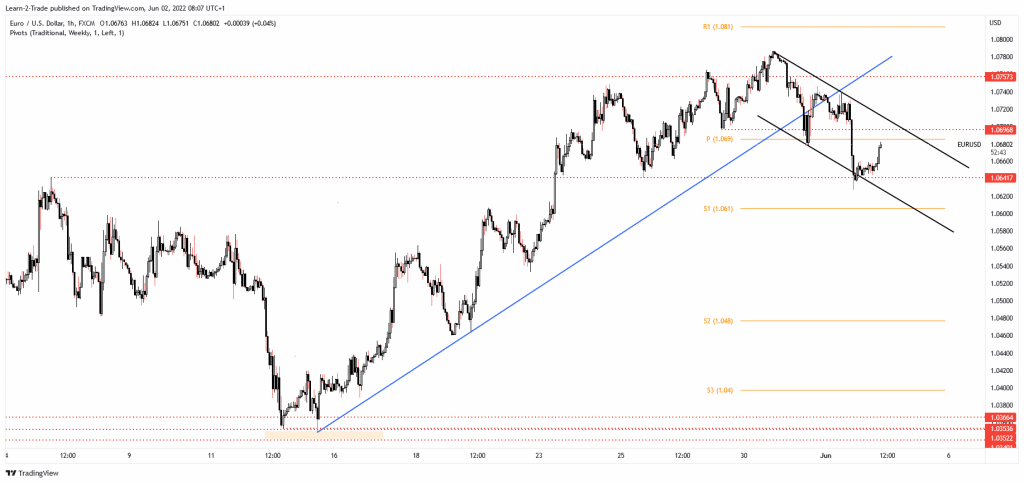

- The EUR/USD pair could resume its drop if it stays under the downtrend line.

- A new lower low could activate more declines.

- The 1.0757 represents a major static resistance.

The EUR/USD price is trading in the green at 1.0680, at the time of writing. The price rebounded as the Dollar Index dropped.

-Are you interested in learning about forex indicators? Click here for details-

Technically, the price action signaled the buyers were exhausted, but a larger drop can confirm the bearish bias. In the short term, it has developed a minor down channel. It remains to be seen if this will be a bullish continuation pattern or if the rate activates a deeper drop inside of this formation.

The US ADP Non-Farm Employment Change is seen as a high-impact indicator and is expected at 295K in May versus 247K in the previous reporting period. In addition, the Unemployment Claims could be reported at 210K in the last week while the Factory Orders could register a 0.8% growth.

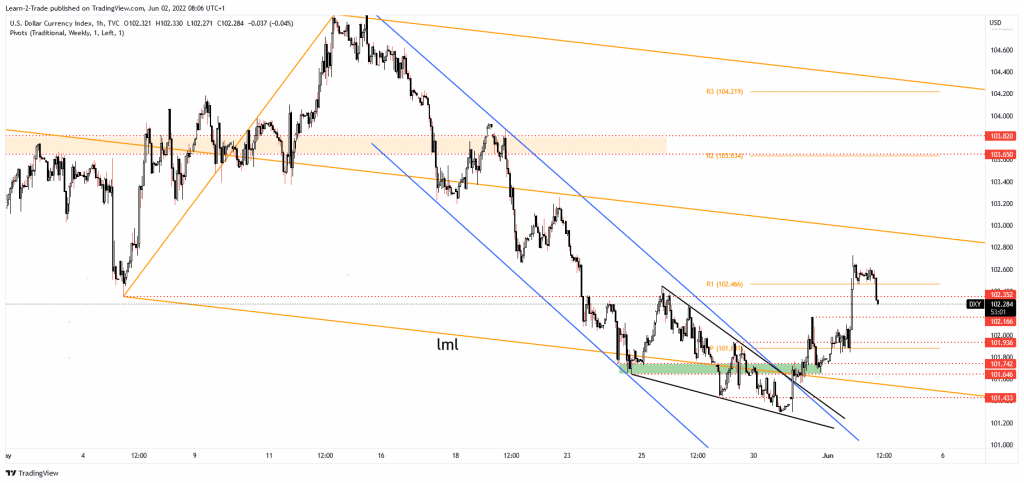

Dollar Index price technical analysis: Bearish bias

As you can see from the 1-hour chart, the Dollar Index dropped after reaching 102.73. Still, the sell-off could be only a temporary one. It could come back down to test the 102.35 and 102.16 before resuming its growth. A minor retreat was natural after its strong growth. An upside continuation should force the USD to appreciate versus its rivals.

EUR/USD price technical analysis: Flag pattern

The EUR/USD pair plunged after failing to stay above the uptrend line and after trying to retest this broken dynamic support. It has found support on the channel’s downside line and at 1.0641. It has registered a false breakdown through the confluence area formed at the intersection between the near-term downside obstacles.

-Are you interested in learning about the forex signals telegram group? Click here for details-

It could come back to test the 1.0696 resistance (support turned into resistance) and the downtrend line in the short term. The EUR/USD pair could drop again if it stays under these upside obstacles. The 1.0757 is seen as a major upside obstacle. The rate failed to stabilize above it, signaling that the swing higher is over. A new lower low, a valid breakdown below 1.0641, could activate a larger downside movement.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money