- The EUR/USD pair remains bearish despite temporary rebounds.

- Taking out the downside obstacles activates more declines.

- Only a new higher high, a valid breakout through the downtrend line, may confirm a new leg higher.

The EUR/USD price extended its sell-off after failing to return to the 0.9700 psychological level. The pair is trading at 0.9599 at writing above 0.9542 new lower low was registered today.

-Are you looking for automated trading? Check our detailed guide-

Fundamentally, the USD remains strongly bullish and dominates the currency market after the FOCM 75bps rate hike in the September meeting and because the FED is expected to continue hiking rates.

Yesterday, the US economic data came in mixed. Durable Goods Orders, Core Durable Goods Orders, and HPI reported worse than expected data. Still, the USD was boosted by the CB Consumer Confidence, New Home Sales, and Richmond Manufacturing Index indicators which came in better than expected.

The German Gfk Consumer Climate was reported at -42.5 points, far below -38.9 points expected.

Later, the US Goods Trade Balance is expected to be at -88.9B versus -90.2B in the previous reporting period. Prelim Wholesale Inventories may report a 0.4% growth in August compared to 0.6% growth in July, while Pending Home Sales could register a 0.9% drop in August after a 1.0% drop in July.

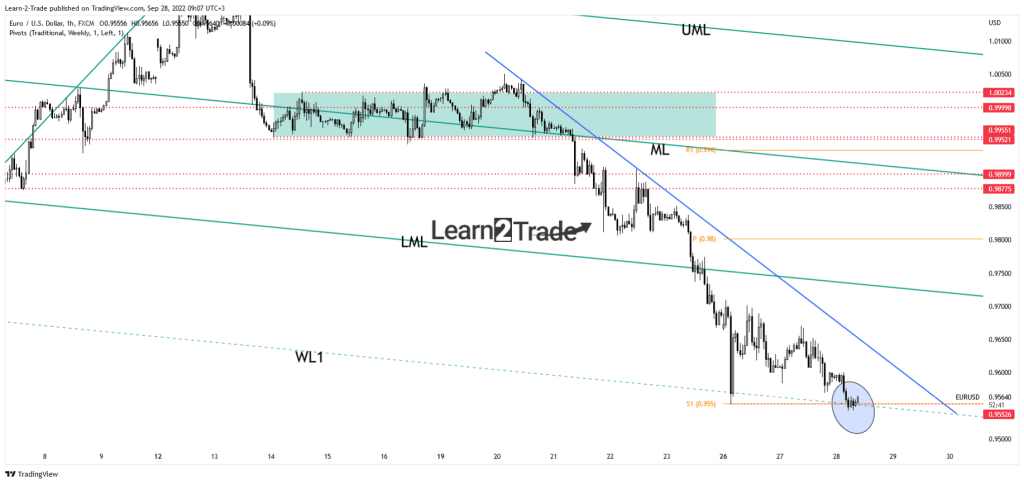

EUR/USD price technical analysis: Confluence area

As you can see from the hourly chart, the EUR/USD extended its sell-off after failing to make a new higher high or retest the descending trendline. The bias is bearish as long as it stays under this dynamic resistance. Its failure to reach it signaled strong selling momentum.

-If you are interested in forex day trading, then read our guide to getting started-

Now, it challenges the 0.9552 former low, the warning line (wl1), and the weekly S1 (0.9550). These are seen as critical downside obstacles. The RSI and the price action signaled a bullish divergence, but only a valid breakout through the near-term downtrend line may signal new bullish momentum.

On the other hand, taking out the downside obstacles and making a new lower low activates more declines. In the short term, the price action developed a triangle pattern. Escaping from this formation could bring new trading opportunities.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.