- The EUR/USD pair maintains a bearish bias despite temporary rebounds.

- Making a valid breakdown below the support zone may signal more declines.

- Its failure to make a new high signaled that the sellers could take the lead again.

The EUR/USD price plunged after the ECB and broke below the 1.0800 mark. Today, it climbed as high as 1.0923, where it found resistance. However, you might know from my analyses that the bias remains bearish despite temporary rebounds.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

After its massive drop, temporary growth was natural and expected. However, the currency pair erased the short-term gains, and it seems determined to resume its downside movement if the Dollar Index resumes its growth.

The DXY is bullish, despite temporary declines. The index retreated a little, but it could climb towards new highs anytime as the FED is expected to raise its Federal Funds Rate by 50-bps in May.

The price plunged as the European Central Bank maintained its monetary policy. The Main Refinancing Rate was left at 0.00%, matching expectations. The asset purchases will likely end in the third quarter.

On the other hand, the US data came in mixed earlier. The Retail Sales indicator rose by 0.5% in March versus 0.6% expected, while the Core Retail Sales registered a 1.1% growth versus 1.0.% estimates compared to 0.2% in the previous reporting period.

Furthermore, the Unemployment Claims were reported at 185K in the last week versus 172K forecasts, while the Import Prices rose by 2.6%, beating the 2.3% estimates. Later, the US is to release the Business Inventories, the Prelim UoM Inflation Expectations, and the Prelim UoM Consumer Sentiment.

EUR/USD price technical analysis: Sell-off triggers

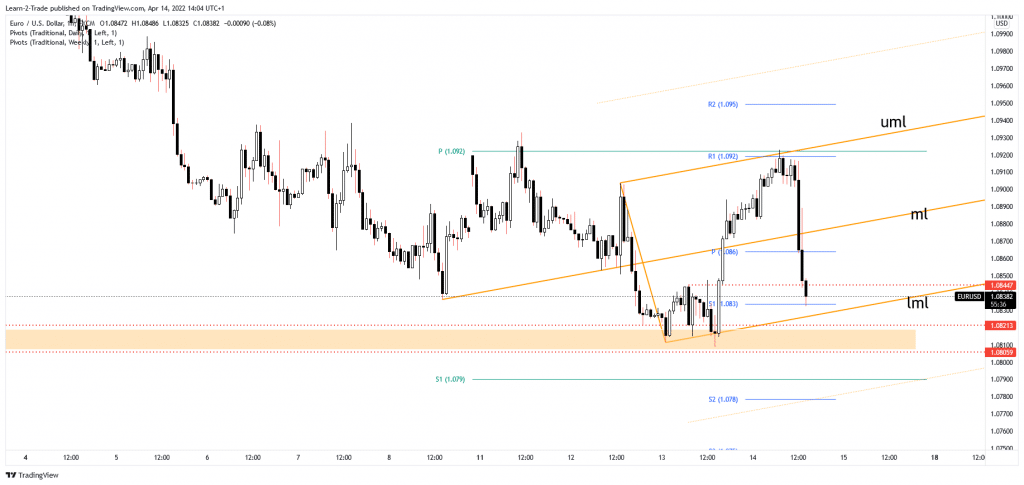

As you can see on the 1-hour chart, the EUR/USD pair found resistance at the weekly pivot point of 1.0920 and at the ascending pitchfork’s upper median line (UML). The rebound was only a temporary one. The price could hit the 1.0821 – 1.0805 support zone anytime.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

A valid breakdown below the lower median line (LML) and through this support zone may signal more declines. On the other hand, its failure to make a new high signaled that the bulls were exhausted and that the sellers were still in control.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money