- The bias remains bullish in the short term as long as it stays above the R1.

- A new higher activates further growth.

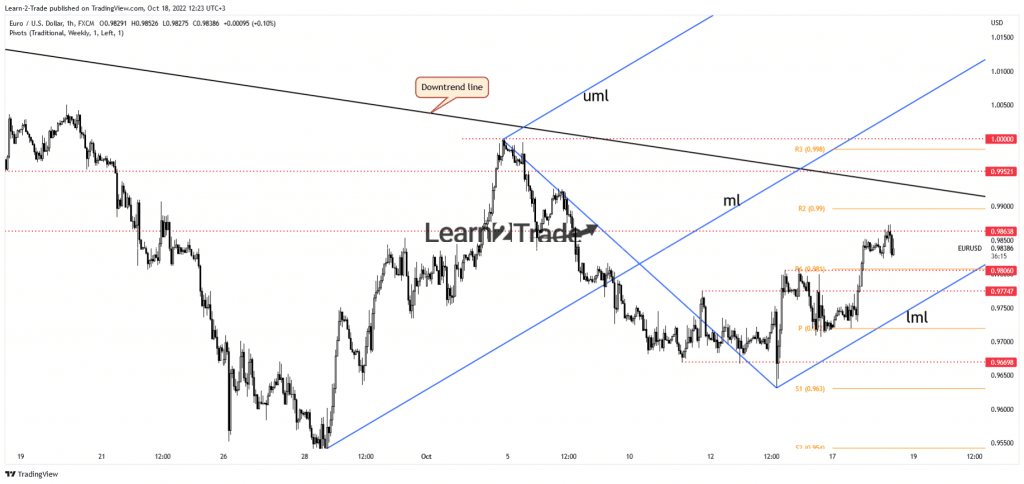

- The downtrend line represents a major upside target and obstacle.

The EUR/USD price rallied in the short term as the US dollar was in a corrective phase. The pair is trading at 0.9838 at the time of writing, below 0.9873 today’s high.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Despite the current recovery, the bias remains bearish. The Dollar Index is expected to register only a temporary drop. The US reported higher inflation in September, so the FED is expected to increase the Federal Funds Rate in the next meeting.

A 75bps rate hike could be in the cards again. The currency pair continues to stay higher also because the USD took a hit from the Empire State Manufacturing Index, which came in at -9.1 points, far below the -4.3 points expected.

Today, the German ZEW Economic Sentiment was reported at -59.2 points versus -66.7 points expected, while the Euro-zone ZEW Economic Sentiment came in at -59.7 points better than the -61.2 points expected.

Later, the US is to release the Capacity Utilization Rate, expected at 80.0%, and Industrial Production, which may report a 0.1% in September versus the 0.2% drop in the previous reporting period.

Tomorrow, the Eurozone Final CPI, Final Core CPI, and the US Housing Starts and Building Permits could have an impact. In addition, the UK and Canadian inflation figures could really shake the markets.

EUR/USD price technical analysis: Leg higher

From the technical point of view, the EUR/USD pair registered an aggressive breakout through the 0.9806 former high, signaling the potential for further growth. Now, it has found resistance at the 0.9863 historical level. So, an upside continuation could be activated only after taking out this obstacle. The upside pressure remains strong as long as it stays above the R1 (0.9810).

-Are you looking for the best MT5 Brokers? Check our detailed guide-

The down trendline is a potential upside target and a major obstacle if the rate continues to grow. Also, the 1.0000 (parity) represents an upside obstacle. Failing to make a valid breakout above 0.9863 may signal exhausted buyers. The ascending pitchfork’s lower median line (LML) represents dynamic support. The EUR/USD pair could still resume leg higher if it stays above it.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.