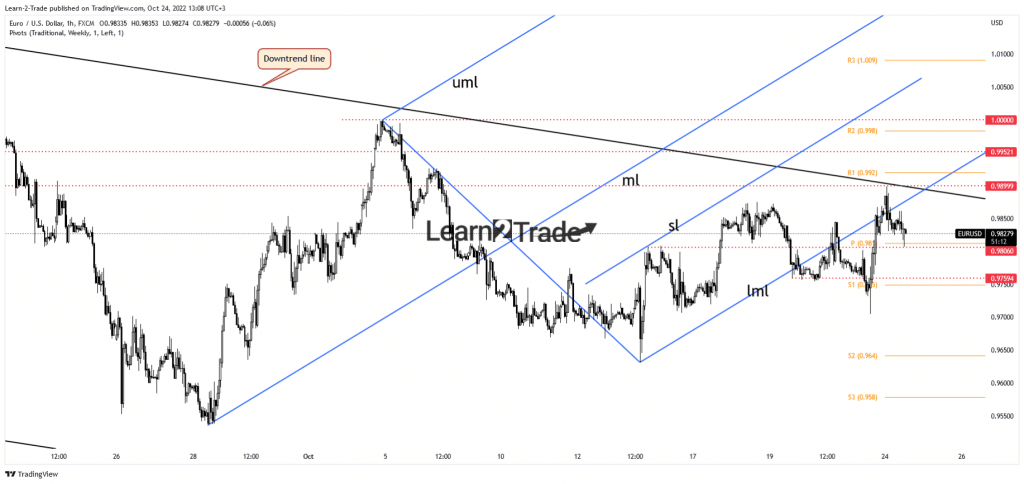

- The bias remains bearish as long as it stays under the downtrend line.

- A new lower low activates a downside continuation.

- The US data could be decisive later today.

The EUR/USD price rallied on Friday as the US dollar slumped after Japan’s new intervention in the FX market.

Still, the dollar sell-off could only be a temporary one. The currency pair maintains a bearish bias. Today, the fundamentals could drive the price. The German Flash Manufacturing PMI came in at 45.7 points below 46.9 expected, compared to 47.8 in the previous reporting period.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

In comparison, the German Flash Services PMI dropped from 45.0 to 44.9 points signaling further contraction.

Furthermore, the Eurozone Flash Manufacturing PMI was reported at 46.6 points versus 47.9 estimates. At the same time, the Flash Services PMI came in better than expected, at 48.2 points, above 48.1 forecasted but below 48.8 in the previous reporting period.

In addition, the French Flash Services OMU came in worse than expected, signaling a slowdown in expansion. In contrast, French Flash manufacturing PMI was reported at 47.4 points above 47.0 expected, but it’s still deep in the contraction territory.

Later, the US data could be decisive. The Flash Services PMI indicator is expected at 49.6 points, above 49.3 points in the previous reporting period, while Flash Manufacturing PMI could drop from 52.0 points to 51.0 points.

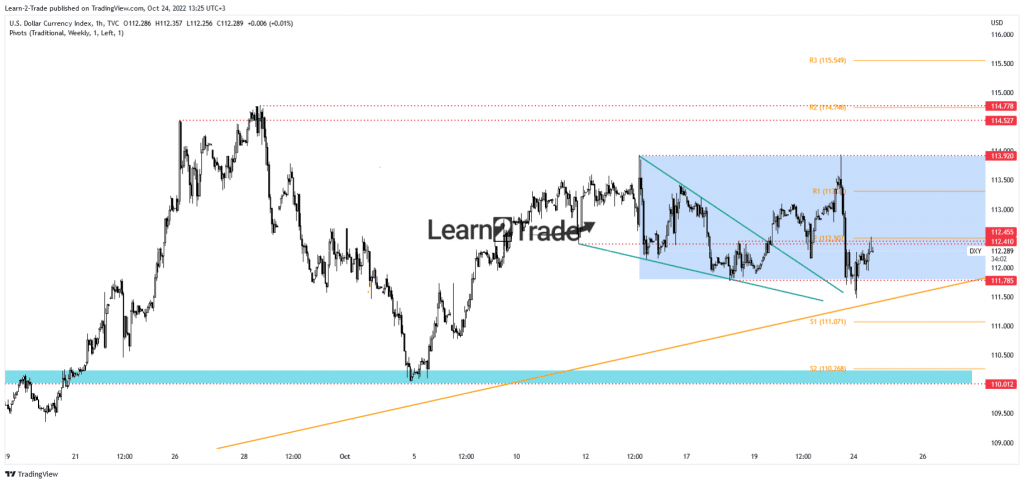

Dollar Index price technical analysis: Ranging

The Dollar Index slipped after failing to take out the 113.92 resistance. It’s trapped between 111.78 and 113.92 levels. The bias remains bullish as long as it stays above the uptrend line. A new bullish momentum could force the USD to dominate the currency market.

EUR/USD price technical analysis: Bearish bias

As you can see on the hourly chart, the rate reached the historical 0.9899 level but failed to retest the down trendline. As long as it stays below this line, the bias remains bearish. The price rebounded within the ascending pitchfork’s body but dropping below the lower median line (LML) signaled a potential downside movement.

–Are you interested to learn more about making money in forex? Check our detailed guide-

It could move sideways in the short term after registering only a false breakdown below the 0.9759 static support. Only a valid breakout through the 0.9899 and above the downtrend line could activate a larger rebound. On the other hand, a new lower low activates more declines, confirming a downside continuation.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.