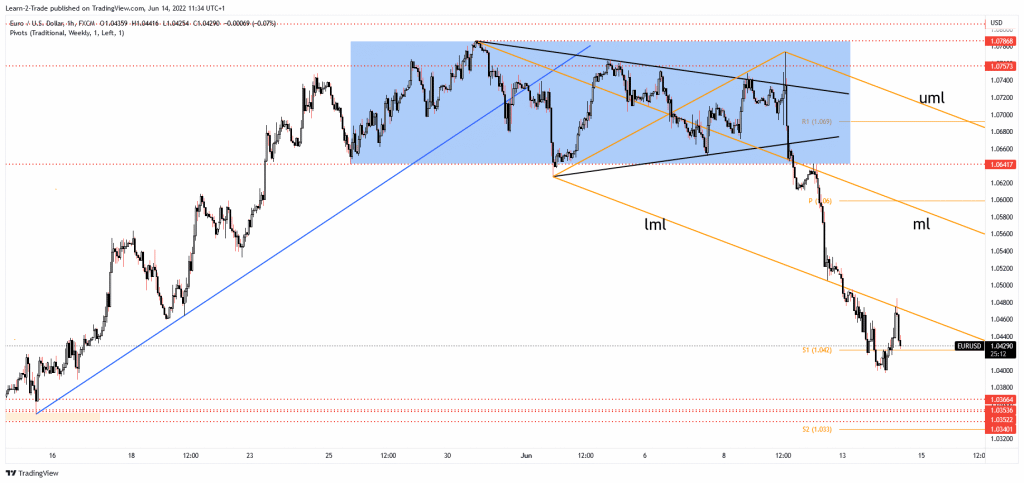

- The EUR/USD pair maintains a bearish bias as long as it stays below the lower median line (LML).

- A new lower low activates more declines.

- The rebound ended, and now it looks to trade lower.

The EUR/USD price rebounded in the short term as the Dollar Index retreated a little after its strong rally. Technically, DXY maintains a bullish bias despite temporary corrections.

-Are you interested in learning about forex tips? Click here for details-

As you already know, DXY’s further growth should force the USD to appreciate versus its rivals. The currency pair was trading at 1.0433 at the time of writing, well below today’s high of 1.0484. The bias is bearish, so a further drop is expected. Still, only a new lower low could activate more declines.

Fundamentally, the Euro hit the Eurozone ZEW Economic Sentiment, which came in at -28.0 points versus -24.5 expected. The German ZEW Economic Sentiment was reported at -28.0 points below -26.9 forecasts.

Later, the US PPI is expected to register a 0.8% growth versus 0.5% in the previous reporting period, while the Core PPI may report a 0.6% growth. The volatility could be high tomorrow, and the EUR/USD pair may register sharp movements in both directions.

The Federal Reserve is expected to increase its Federal Funds Rate from 1.00% to 1.50%. However, there are bets of a 75-bps rate hike as well due to the hotter-than-expected inflation. The FOMC Statement and the FOMC Press Conference could be decisive. Also, the US retail sales data could bring more action.

EUR/USD price technical analysis: Swing down

The EUR/USD pair plunged after failing to make a new higher high. The valid breakdown through the 1.0641 activated a massive sell-off. In the short term, the pair has rebounded, but it lacks the follow-through momentum. As you can see on the 1-hour chart, the price found resistance at the descending pitchfork’s lower median line (LML) of the descending pitchfork, dropping again.

-Are you interested in learning about the forex basics? Click here for details-

The weekly S1 (1.0420) stands as static support. Dropping and stabilizing below it may signal more declines. Also, the 1.0396 former low represents a potential downside target. As long as it stays under the lower median line (LML), the bias remains bearish, and the rate could approach and reach new lows. The 1.0348 lower low could be a potential downside target and obstacle.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money