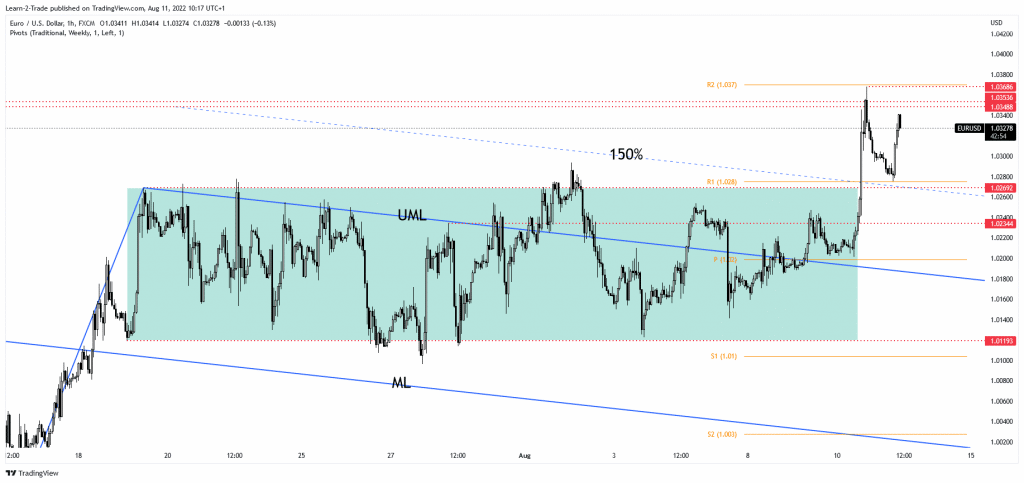

- The EUR/USD pair could extend its leg higher after retesting the R1.

- A new higher high activates further growth.

- After its strong rally, a minor retreat was natural.

The EUR/USD price rallied after ending the short-term sell-off. It was trading at 1.0324 at the time of writing.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

It seems determined to come back higher as the Dollar Index is bearish after the US inflation figures. Technically, the currency pair retreated a little after yesterday’s strong rally. The price came back down to retest the buyers before jumping higher again.

The correction helped the buyers to catch a new leg higher. DXY’s deeper drop should force the EUR/USD pair to approach new highs.

As you already know, the USD dropped after the US CPI reported only a 0.0% growth versus 0.2% expected, while the Core CPI reported only a 0.3% growth compared to the 0.5% growth expected. Lower inflation could stop the current aggressive rate hikes. Still, the FED will continue hiking rates in the next monetary policy meetings.

Today, the US PPI is expected to report a 0.2% growth versus 1.1% growth in the previous reporting period, while the Core PPI may register a 0.4% growth. In addition, the Unemployment Claims indicator increased from 260k to 264K in the last week. This could be bad for the greenback.

EUR/USD price technical analysis: Bullish bias

From the technical point of view, the EUR/USD pair dropped after registering only a false breakout above 1.0353, so a temporary retreat was understandable. It has retested the weekly R1 (1.0280) and could now reach the 1.0348 – 1.0353 resistance zone.

-Are you looking for the best CFD broker? Check our detailed guide-

Yesterday’s high of 1.0368 represents an upside obstacle as well. You knew from my analyses that the EUR/USD pair could extend its upwards movement after making a valid breakout above 1.0269. Escaping from the extended range pattern signaled a more significant rebound. Still, you should remember that the bias remains bearish in the medium to the long term despite the current leg higher.

A larger upwards movement could be activated only by a new higher high. Jumping, closing, and stabilizing above the 1.0368 level could confirm an upside continuation.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.