- The bias remains bullish after taking out the resistance levels.

- Testing and retesting the support levels could bring a new upside momentum.

- US data could shake the markets today.

The EUR/USD price extended its rally as the US dollar continued its bearish momentum. The pair is trading at 1.0524 at the time of writing, a bit below today’s high of 1.0544.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

The bias remains bullish in the short term despite minor retreats. You knew from my analyses that the US economic data should move the markets during the week. Yesterday, the greenback took a hit from the Core PCE Price Index, which reported a 0.2% growth versus the expected 0.3% growth, compared to the 0.5% growth in the previous reporting period. From the ISM Manufacturing PMI, the indicator dropped from 50.2 to 49.0, below 49.7 expected signaling contraction. In addition, Wards’ Total Vehicle Sales, ISM Manufacturing Prices, and Construction Spending came in worse than expected.

Today, the US data could change the sentiment as the US is to release high-impact data again. The Non-Farm Employment Change could be reported at 200K in November, below 261K in October. Average Hourly Earnings are expected to report a 0.3% growth, while the Unemployment Rate could remain steady at 3.7%.

On the other hand, the Eurozone data came in mixed. Better than expected, US data could lift the greenback, while poor figures could weaken the USD.

EUR/USD price technical analysis: Bulls exhausting

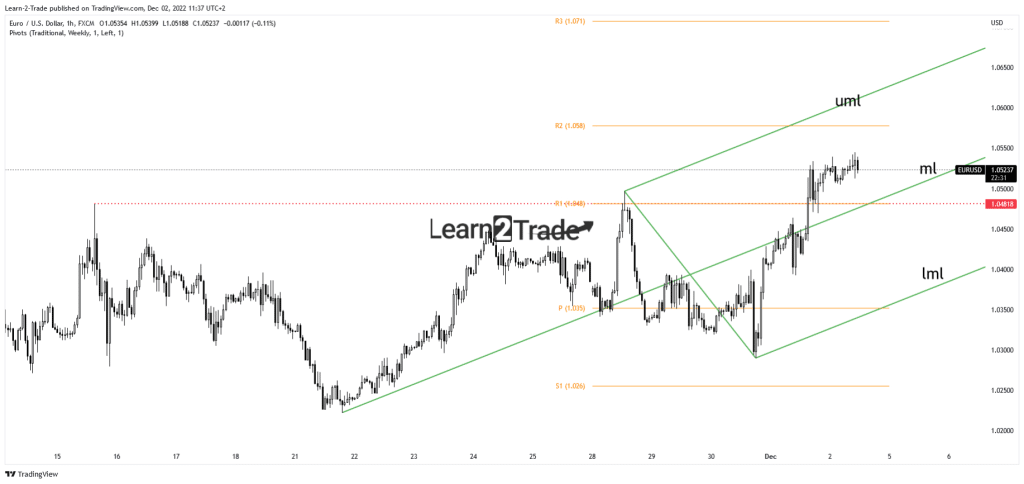

Technically, the price registered a valid breakout above 1.0481 through the R1 (1.0480), signaling strong buyers and potential further growth. The ascending pitchfork’s median line (ML) represents dynamic support. As long as it stays above the median line, it could resume its growth. Still, after its strong growth, we cannot exclude a minor retreat.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

Testing the median line and the 1.0481, registering only false breakdowns, may announce further growth. A new higher high, jumping and closing above 1.0544, also activates further growth. An upside continuation could be invalidated only by a valid breakdown below the median line and under the 1.0481 static support. As long as it stays above the median line (ML), the upper median line (UML) could attract the rate.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.