- The EUR/USD pair confirmed its breakdown, so more declines are expected.

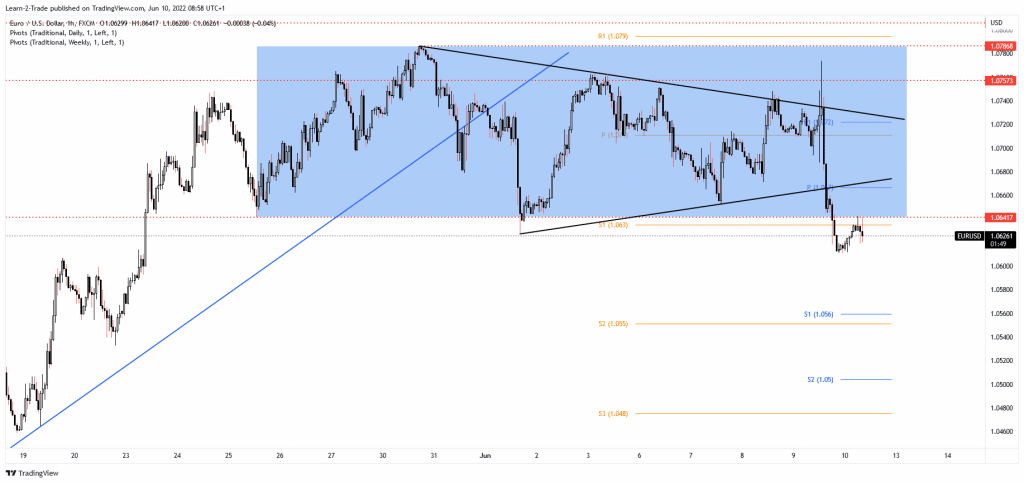

- The false breakout with great separation through the 1.0757 signaled a new sell-off.

- Stabilizing below the S1 signal a potential drop towards the S2.

The EUR/USD price plunged after reaching the 1.0773 level. Now, it is trading at 1.0625, and it seems poised to reach new lows. As you already know, the Dollar Index rallied in the last trading session boosting the greenback.

-Are you interested in learning about the best AI trading forex brokers? Click here for details-

Technically, the currency pair signaled that the upside was over and the sellers could take full control. In the short term, the pair rebounded because the DXY retreated after its strong rally.

The EUR/USD pair could only test the immediate resistance levels before resuming its sell-off. Surprisingly or not, the USD rallied after the ECB. The Main Refinancing Rate was left at 0.00%, but the interest rate is expected to be increased by 0.25% in July. On the other hand, the US Unemployment Claims came in at 229K versus 205K estimates.

Today, the US inflation data could be decisive. The fundamentals will drive the markets, and the volatility could be high. The US Consumer Price Index is expected to report a 0.7% growth in May versus 0.3% in April, while the Core CPI could register a 0.5% growth in the last month.

EUR/USD price technical analysis: Ranging

Technically, the rate registered a new false breakout through the 1,0757, signaling exhausted buyers and a potential sell-off. The EUR/USD pair actually invalidated its upside breakout from the triangle pattern announcing a downside breakout. As you can see on the 1-hour chart, the rate registered a valid breakdown below the uptrend line and through the 1.0641 confirming more declines.

-Are you interested in learning about the forex indicators? Click here for details-

Escaping from the major range pattern signals the upside movement and that the EUR/USD pair could come back down. A new lower low, dropping and closing below 1.0611, activates a new sell-off, a downside continuation. The 1.0757 represented a major upside resistance. Its failure to stabilize above it showed an overbought. Stabilizing below the S1 (1.0630) indicates a potential drop towards the S2 (1.0550).

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money