- The ECB could bring high volatility and sharp movements.

- A new lower low could activate a more significant sell-off.

- A valid breakout through the upper media line and a new higher high could confirm further growth.

The EUR/USD price dropped in the short term as the Dollar Index tried to recover after its massive drop. Still, the sell-off could be temporary before the currency pair resumes its swing higher.

–Are you interested to learn more about forex signals? Check our detailed guide-

Technically, the price signaled that the buyers were exhausted in the short term, and the sellers could take the lead. Unfortunately, the price was stopped by a near-term downside obstacle invalidating a more significant sell-off. Fundamentally, the Eurozone economic data came in worse than expected yesterday.

The Consumer Confidence came in at -27 points below -25, Current Account was reported at -4.5B versus 4.5B expected, while the German PPI rose by 0.6% less compared to 1.6% estimated. The EUR/USD pair ended their drop also because the US Existing Home Sales came in at 5.12M below 5.37M expected.

Today, the ECB could shake the markets. The EUR/USD pair will most likely register sharp movements in both directions around this high-impact event. As you already know, the European Central Bank is expected to increase the Main Refinancing Rate by 25bps from 0.00% to 0.25%.

The ECB Press Conference and the Monetary Policy Statement could bring high volatility. That’s why you need to be careful. In addition, the US is to release its Unemployment Claims, Philly Fed Manufacturing Index, and the CB Leading Index.

EUR/USD price technical analysis: Correction

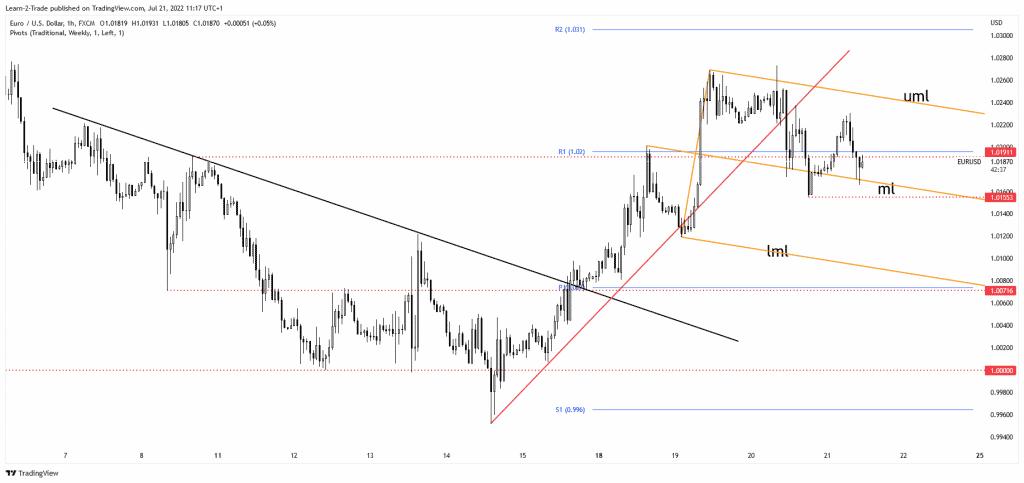

The EUR/USD pair retreated a little after dropping below the uptrend line. Still, it has failed to stabilize below the median line (ml), which stands as a dynamic support. The 1.0155 yesterday’s low stands as static support. Now, it has retested the median line, and it tries to come back higher. Only a new lower low, dropping and closing below 1.0155, could activate more declines.

–Are you interested to learn more about automated trading? Check our detailed guide-

The upper median line (UML) stands as a dynamic resistance. A valid breakout above it and a new higher high could confirm an upside continuation. Personally, I’ll wait to see how it will react after the ECB before taking action.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money