- The EUR/USD pair maintains a bearish bias despite the current rebound.

- The US data could be decisive later today.

- A new lower low may activate more declines.

The EUR/USD price dropped in the last hours. The pair is trading at 0.9780 at the time of writing. As you already know, the price rallied in the short term as the US dollar was in a corrective phase. DXY’s deeper drop should force the pair to approach new highs in the short term.

–Are you interested to learn more about AI trading brokers? Check our detailed guide-

We have a strong negative correlation between the DXY and the EUR/USD. Fundamentally, the US data came in mixed on Friday. The Core PCE Price Index rose by 0.6% versus 0.5% growth expected, while Revised UoM Consumer Sentiment dropped unexpectedly from 59.5 to 58.6.

Today, the US is to release the ISM Manufacturing PMI, which stands as a high-impact indicator and is expected to be at 52.5 points versus 52.8 points in the previous reporting period. Final Manufacturing PMI is expected to remain at 51.8 points; Construction Spending could report a 0.1% growth, and ISM manufacturing Prices may drop from 52.5 to 52.0. In contrast, Wards’ Total Vehicle Sales are expected to jump from 13.2M to 13.6M.

On the other hand, the German Final Manufacturing PMI and the Eurozone Final Manufacturing PMI came in worse than expected, signaling contraction.

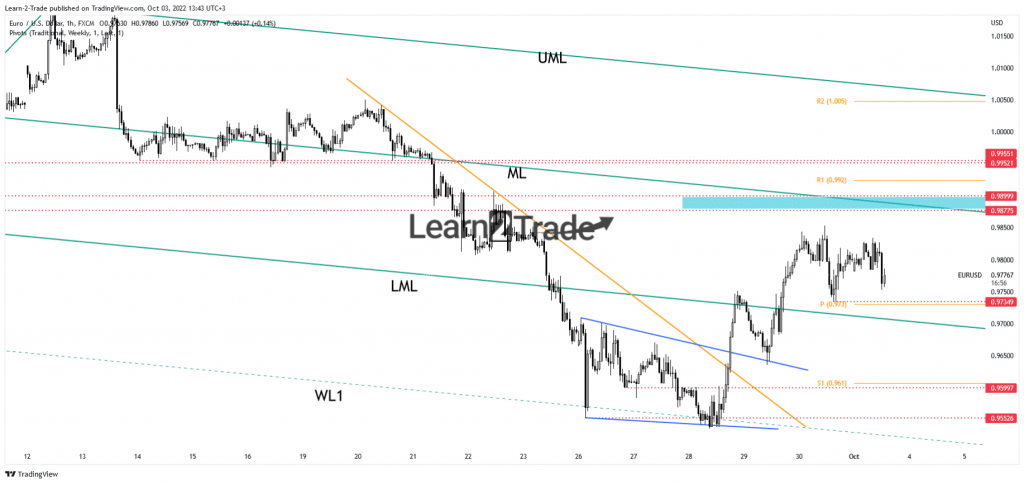

EUR/USD price technical analysis: Swing higher

As you can see on the 4-hour chart, the EUR/USD pair failed to approach and reach the 0.9853 former high, signaling exhausted buyers. It may come back to test the 0.9734 immediate low and the weekly pivot point of 0.9730. In the short term, it could move sideways. An accumulation may signal further growth, but it remains to see as the DXY maintains a bullish bias despite the current correction.

–Are you interested to learn more about Canada forex brokers? Check our detailed guide-

The 0.9877 – 0.9899 area and the median line (ML) represent potential upside obstacles if the rate continues to grow. Technically, coming back below the lower median line (LML) and under the 0.97 psychological level may signal more declines. Testing the pivot point, registering only false breakdowns may result in new upside momentum.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.