- EUR/USD price remains rangebound on Thursday despite dismal US GDP data.

- German consumer confidence data missed expectations.

- Market awaits Jackson Hole Symposium and Powell’s speech to find the fresh impetus.

The EUR/USD price fluctuates within a narrow range above 1.1750 as it seeks to continue its steady upward movement during the second half of the week.

Over the past week, the risk climate has been more favorable, however, weighing on the dollar. As a result, the EUR/USD pair has been rebounding off new YTD lows near 1.1660 (Aug 20) amid upside risks.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

With disappointment looming over PMI numbers for major economies in the Eurozone and mixed results reported from the IFO survey in Germany, the single currency is holding strong. A GfK measure of German consumer confidence did not reach -1.2 for September (from -0.4) at the beginning of the meeting.

The EUR/USD pair is trading around 1.1750, which is not positive on this day as US GDP missed expectations with 6.6% y/y growth, and jobless claims were disappointing at 353K. Perhaps, the Fed Chairman’s speech at Jackson Hole this week is a concern for market participants.

Experts predict Powell’s team will begin cutting its $120 billion in monthly QE bond purchases later this year. As a result, the annual yield on the two-year Treasury bond remained at its highest level since the end of June at 0.24%.

This yield appears to have attracted new investment into the bond market. More than 60% of the demand for US bonds came from foreign investors, but for US investors, the 0.24% yield is still more than 5 full percentage points behind the overall annual consumer price inflation rate.

Meanwhile, the yield on five-year Treasuries rose to 0.79% on Wednesday, while the yield on 10-year bonds hit 1.30% for the first time in two weeks.

According to analysts at the American investment bank Goldman Sachs, there is a 45% chance that the Fed will begin to reduce monthly asset purchases as part of quantitative easing in November. Previously, this figure was 25%.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

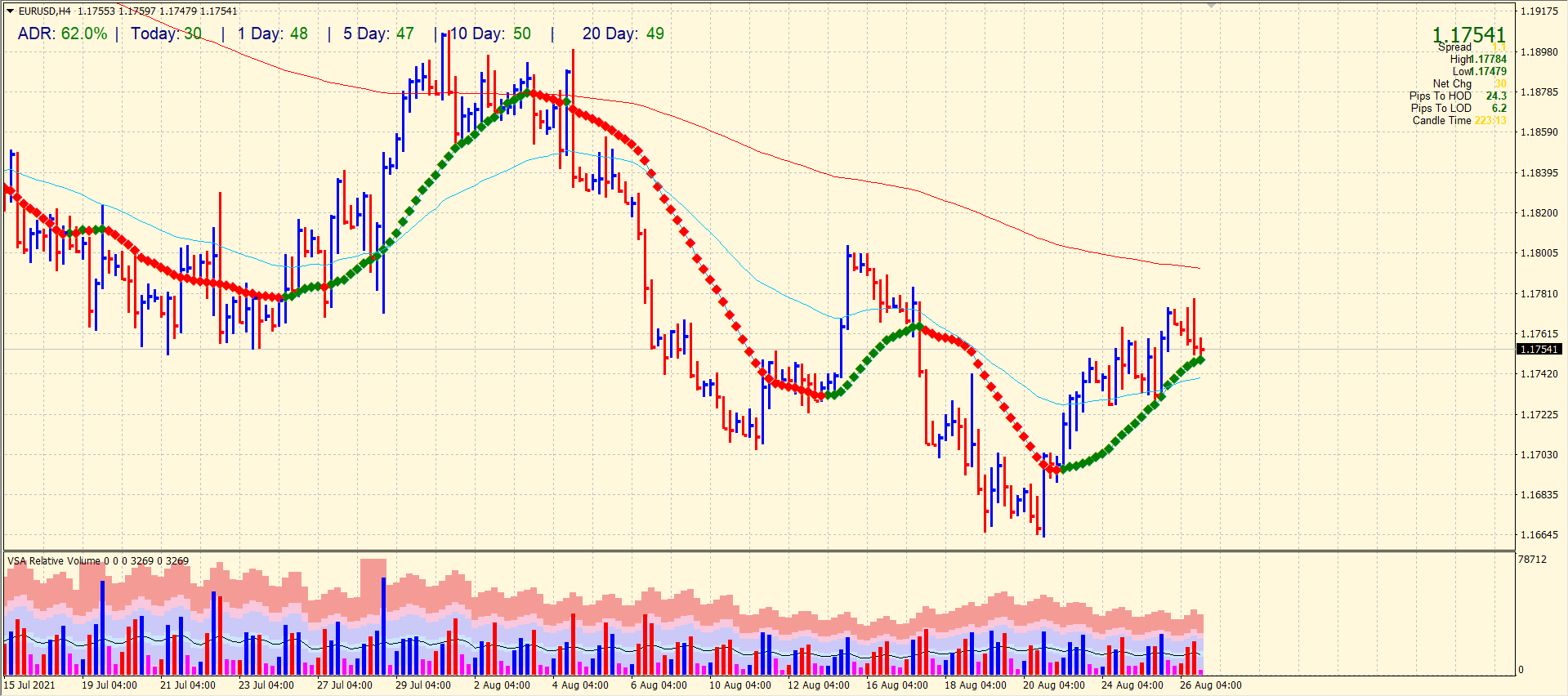

EUR/USD price technical analysis: 20-SMA lending support

The EUR/USD price falls to the mid-1.1700 area coinciding with the 20-period SMA on the 4-hour chart. The pair has covered around 62% average daily range until now. However, it looks like the upside traction got dampened in the recent hour. Further below, the 50-period SMA can provide support at 1.1740 area. However, the key support is still the 1.1700 mark.

On the flip side, 1.1800 and the 200-period SMA are the key hurdles that keep the bearish pressure intact.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.