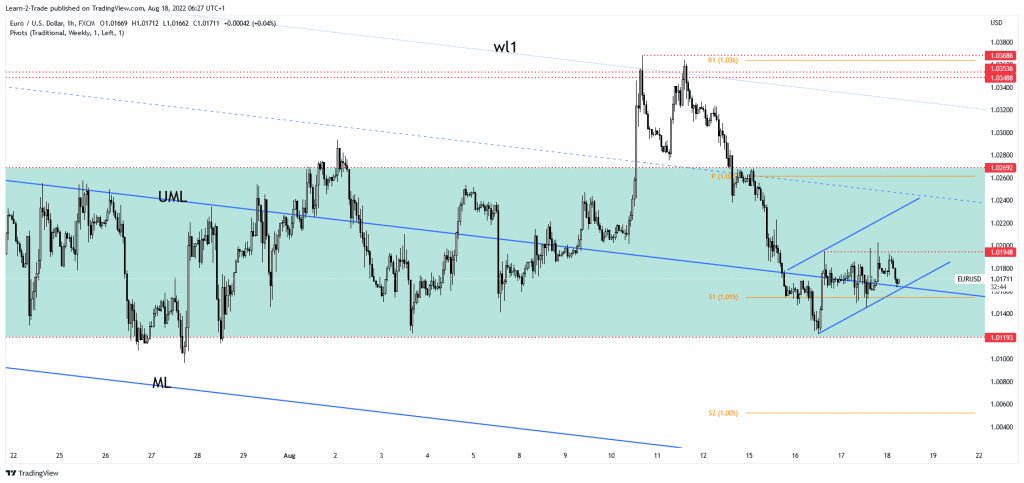

- A valid breakdown through the confluence area may report a downside movement.

- The price action signaled exhausted buyers after failing to stay above 1.0269.

- The flag formation could bring a downside continuation.

The EUR/USD price rebounded in the short term and is now trading at 1.0172. Technically, a temporary bounce back was natural after its massive drop. DXY’s drop helped the currency pair to rebound.

-Are you looking for automated trading? Check our detailed guide-

Still, the Dollar Index continues to stay near strong resistance levels. A valid breakout and formation of a new higher high could signal a significant rise in the index. DXY’s upside continuation should force the USD to dominate the currency market.

Fundamentally, the US economic data came in mixed. The Retail Sales indicator reported a 0.0% growth versus 0.1% expected, while the Core Retail Sales surged by 0.4% compared to a 0.1% drop. Furthermore, the FOMC Meeting Minutes came in line with expectations.

Today, the Eurozone Final CPI may report an 8.9% growth while Final Core CPI could register a 4.0% growth. On the other hand, the US Philly Fed Manufacturing Index is expected at -4.9, and Unemployment Claims could jump to 265K, and Existing Home Sales could come in at 4.87M below 5.12M expected. At the same time, the CB Leading Index may report a 0.5% drop.

EUR/USD price technical analysis: Temporary rebound

The EUR/USD price rebounded after failing to reach the 1.0119 key downside obstacle. The price action developed a minor flag pattern representing a downside continuation formation. It challenged the confluence area formed at the intersection between the upper median line (UML) with the minor uptrend line. The upside momentum was stopped by the 1.0194 level, which stands as static resistance. Activating the flag pattern could signal more declines.

-Are you looking for forex robots? Check our detailed guide-

Still, a new lower low could indicate a significant downside movement. Dropping, closing, and stabilizing below 1.0119 could open the door for a more significant downside movement. After failing to stay above the 1.0269 critical level, the EUR/USD pair signaled that the upside movement ended and that the sellers could take the lead. Only false breakdowns below 1.0119 could invalidate the downside scenario and could announce a potential bullish momentum.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.