- Escaping from the current range could bring new opportunities.

- A new lower low activates more declines.

- The bias remains bearish despite temporary rebounds.

The EUR/USD price plunged after reaching the 1.0234 level in the morning. It was trading at the 1.0154 level at the time of writing. It continues to move sideways in the short term.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Surprisingly or not, the currency pair rallied after the FOMC even if the FED increased the Federal Funds Rate by 75bps as expected. Further rate hikes are expected in the next monetary policy meetings.

Technically, the bias remains bearish, and a larger rebound is far from being confirmed.

Today, the Spanish Unemployment Rate came in better than expected. The indicator was reported at 12.5% versus 13.2% expected. This could be good for the Euro.

On the other hand, the US economic data came in mixed. Unfortunately for the USD, the Advance GDP reported a 0.9% drop even if the specialists expected a 0.4% growth. After a 1.6% drop in the previous reporting period, the indicator remains deep in the negative territory.

In addition, the Unemployment Claims came in at 256K in the last week versus 253K expected, while the Advance GDP Price Index rose by 8.7%, beating the 7.9% estimates.

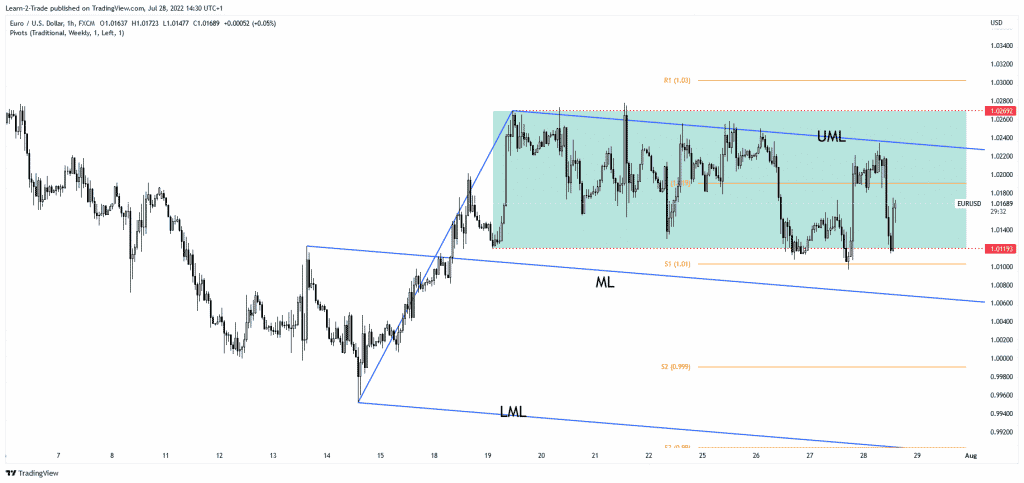

EUR/USD price technical analysis: Ranging pattern

Technically, the currency pair is trapped between the 1.0119 and 1.0269 levels. The false breakdowns from this pattern could signal that the sellers are exhausted and that the price could come back higher in the short term. The descending pitchfork’s upper median line (UML) represents a dynamic resistance, while the 1.0269 stands as a static resistance. On the downside, the weekly S1 (1.01) stands as static support.

–Are you interested to learn about forex robots? Check our detailed guide-

In the short term, it could continue to move sideways. A new lower low or higher high could bring new trading opportunities. It remains to be seen what will happen as the rate failed to approach and reach the former highs in the previous attempts, indicating exhausted buyers. In my opinion, a new lower low could activate more declines. A more significant downside movement could be confirmed only by a valid breakdown below the median line (ML).

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.