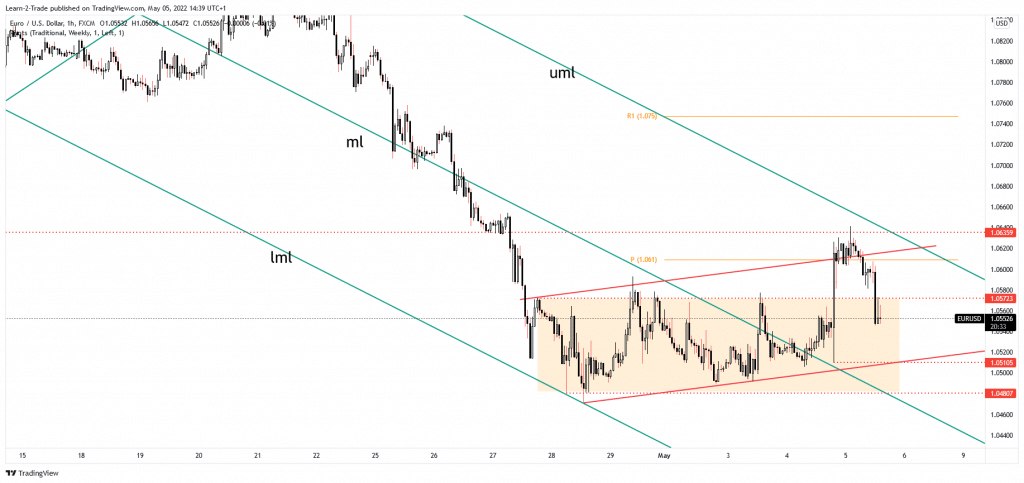

- The EUR/USD pair maintains a bearish bias while it stays under the upper median line (UML).

- The channel’s downside line stands as an immediate downside obstacle.

- Only a new lower low could activate a larger drop.

The EUR/USD price rallied right after the FOMC, but the rebound seems over as the Dollar Index has managed to recover after its massive drop. The pair is trading at a 1.0554 at the time of writing, and it could drop deeper if the DXY resumes its growth.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

The bias remains bearish. It could approach fresh lows. As you already know, the Federal Reserve is expected to continue hiking rates in the next monetary policy meetings. The Federal Funds Rate was increased by 50bps in the May meeting, from 0.50% to 1.00%.

The analysts are expecting 50bps hikes in the upcoming meetings as well. Hawkish FED could help the USD resume its appreciation and dominate the currency market.

Today, the Euro took a hit from the German Factory Orders, which reported a 4.7% drop versus 1.0% expected, while the French Industrial Production dropped by 0.5% more compared to the 0.2% forecasts.

The greenback is bullish even if the US Unemployment Claims came in at 200K in the last week versus 180K estimates and 180K in the previous reporting period. Furthermore, Prelim Unit Labor Costs reported a 11.6% growth compared to 10.1% forecasts, while Prelim Nonfarm Productivity fell by 7.5%, more than the 5.1% drop expected.

EUR/USD price technical analysis: Uptrend channel

The EUR/USD pair rallied after jumping above the descending pitchfork’s median line (ml). It climbed as much as 1.0641, but it registered only a false breakout above the 1.0635 static resistance.

–Are you interested in learning more about Australian brokers? Check our detailed guide-

Also, it has failed to stabilize above the channel’s upside line, signaling that the buyers are exhausted. As a result, 1.0510 and the channel’s upside line represent near-term downside targets. However, after its massive drop, the EUR/USD pair could try to rebound after reaching these support levels.

Technically, only a valid breakdown below 1.0480 could activate a larger downside movement. The bias remains bearish as long as it stays under the upper median line (UML). Only a valid breakout through this dynamic resistance could signal that the downside is over.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money