- The EUR/USD pair drops as the Dollar Index tries to rebound.

- The price signaled a more significant swing higher after taking out the 1.0191 resistance.

- The ECB could shake the markets on Thursday.

The EUR/USD price is trading in the red at 1.0244 at the time of writing. After its strong rally, a downside correction is natural.

–Are you interested to learn more about forex signals? Check our detailed guide-

The price may slip back to test the near-term downside obstacles before resuming its uptrend. Technically, the price action signaled a strong swing higher as the Dollar Index entered a corrective phase.

Yesterday, the US economic data came in mixed, while the Italian Trade Balance reported better than expected data.

Today, the Eurozone Final CPI was reported at 8.6%, matching expectations, while the Final Core CPI came in at 3.7%, as expected. Later, the US economic figures could bring some volatility. Housing Starts are expected at 1.57M versus 1.55M in the previous reporting period, while Building Permits could drop from 1.70M to 1.64M.

Tomorrow, the Eurozone Current Account, the Consumer Confidence, and the US Existing Home Sales could stimulate the EUR/USD pair.

The week’s most important event is the ECB’s rate decision in its next meeting. As you already know, the European Central Bank is expected to raise the Main Refinancing Rate from 0.00% to 0.25% on Thursday. The Monetary Policy Statement and the ECB Press Conference could shake the markets.

EUR/USD price technical analysis: Retracing from the local high

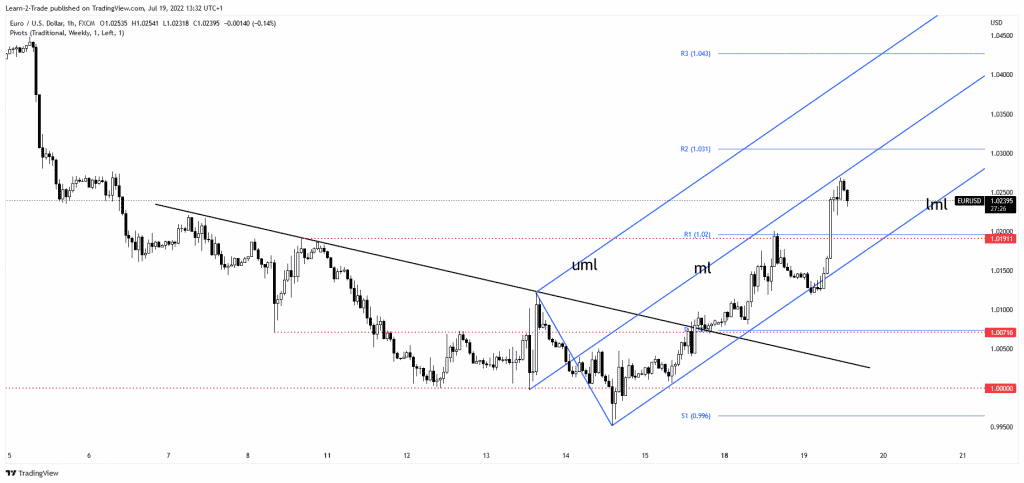

The currency pair rallied after registering only a false breakdown below the ascending pitchfork’s lower median line (LML). It is about to reach the median line (ml), a potential dynamic resistance.

–Are you interested to learn more about automated trading? Check our detailed guide-

After its aggressive breakout through 1.0191, the EUR/USD pair signaled an upside continuation. Still, we cannot exclude a temporary drop. The price could come back to retest this broken resistance.

The median line (ml) and the weekly R2 (1.0310) are near-term upside obstacles. From the technical point of view, as long as it stays within the ascending pitchfork’s body, the EUR/USD pair could climb towards new highs. A valid breakdown below the lower median line (LML) signals that the swing higher could be over.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money