- The EUR/USD posted its first daily loss three days after pulling back from intraday highs.

- A faster normalization of monetary policy was unsettling to ECB’s Panetta and Fed’s Bostic.

- The US inflation expectations rose to a 14-week high, and Treasury yields supported DXY gains.

- Despite inconclusive peace talks, Russia continues to invade Ukraine, giving bears hope.

During earlier European session on Tuesday, the EUR/USD price recovered from intraday losses in the 1.1200 area. However, for the first time in three days, the major currency pair lost 0.10% daily, showing a rebound in the US dollar amid slack markets.

–Are you interested in learning more about managed forex accounts? Check our detailed guide-

Investors are likely concerned due to mixed news regarding the Russian invasion of Ukraine and cautious sentiment ahead of major data/events.

Regarding risks, the peace talks between Kyiv and Moscow the day before ended without results but were left on the table for further discussion. Despite Russia’s criticism of Western sanctions and aggression in the form of a military invasion of Kyiv, geopolitical risks are far from abating, supporting US dollar demand as a safe-haven asset.

Conversely, an increase in the US 10-year Treasury yield, which rose no more than two basis points (bps) to 1.86%, is helping the US dollar erase recent losses. According to the St. Louis Federal Reserve (FRED), from the latest inflation expectations in the US, which rose to a 14-week high the previous day, yields could be derived based on a 10-year breakeven inflation rate, according to the St. Louis Federal Reserve (FRED).

A bearish probability of a 0.50% Fed rate hike in March is bolstered by comments from Atlanta Fed President Rafael Bostic using the CME FedWatch tool to test US dollar buyers. As quoted by Reuters, Bostic said, “I support a 25-basis-point hike in policy adjustments for the March meeting so as not to smother an incomplete recovery.”

For further direction, EUR/USD traders will watch geopolitical headlines and speeches by ECB President Christine Lagarde and US President Joe Biden. In addition, inflation data for Germany is scheduled for release later in the week.

A further direction to keep an eye on is the harmonized index of consumer prices.

–Are you interested in learning more about crypto brokers? Check our detailed guide-

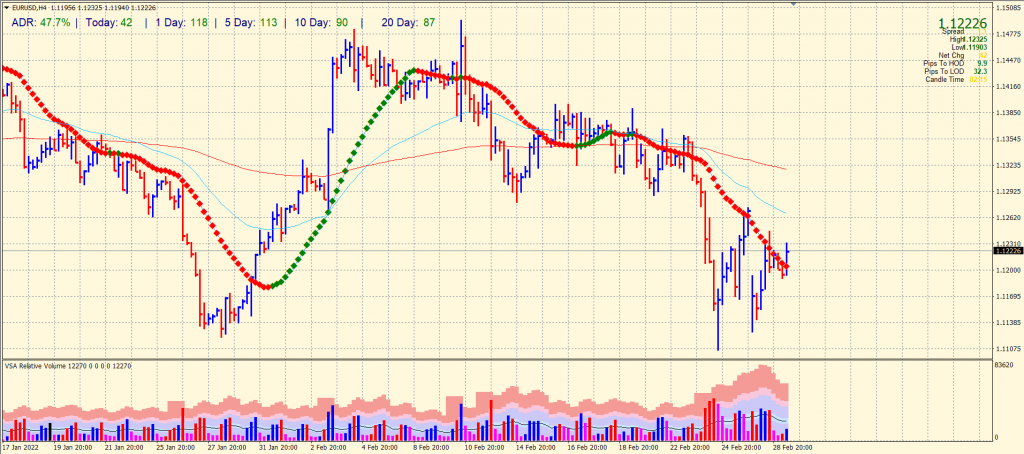

EUR/USD price technical analysis: Bulls struggling to hold

The EUR/USD price is struggling to stay above the 20-period SMA on the 4-hour chart. However, the upside remains shallow as long as the price remains below the 1.1300 area. The downside targets coincide with the 1.1000 level. The volume data is showing no directional bias at the moment. The average daily range Is 47%, showing a probability of mild volatility for the day.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money