- The US Prelim GDP could bring high volatility and sharp movements.

- A new higher high could activate a larger growth.

- Making a valid breakdown below the uptrend line could announce a new sell-off.

The EUR/USD price rebounded after reaching 1.0641. The pair is trading at 1.0686 at the time of writing. The short-term bias remains bullish. The price may resume its rise as the Dollar Index maintains a bearish bias.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

Technically, DXY rebounded after finding strong demand but the bounce-back could be only a temporary one. DXY’s deeper drop could force the USD to depreciate against the other major currencies.

As you already know, the USD remains sluggish as the US Flash Manufacturing PMI, Flash Services PMI, Durable Goods Orders, and the Core Durable Goods Orders came in worse than expected. Still, after the FOMC Meeting Minutes, the greenback tried to rebound.

The Federal Reserve is expected to continue hiking rates in the next monetary meetings.

Today, the US is to release high-impact data, that’s why you need to be careful as the volatility could be high. The Prelim GDP is expected to report a 1.3% drop in Q1 versus a 1.4% drop in the last reporting period, Unemployment Claims could be reported at 217K in the last week, while the Pending Home Sales may report a 1.9% fall in April.

EUR/USD price technical analysis: Bouncing higher

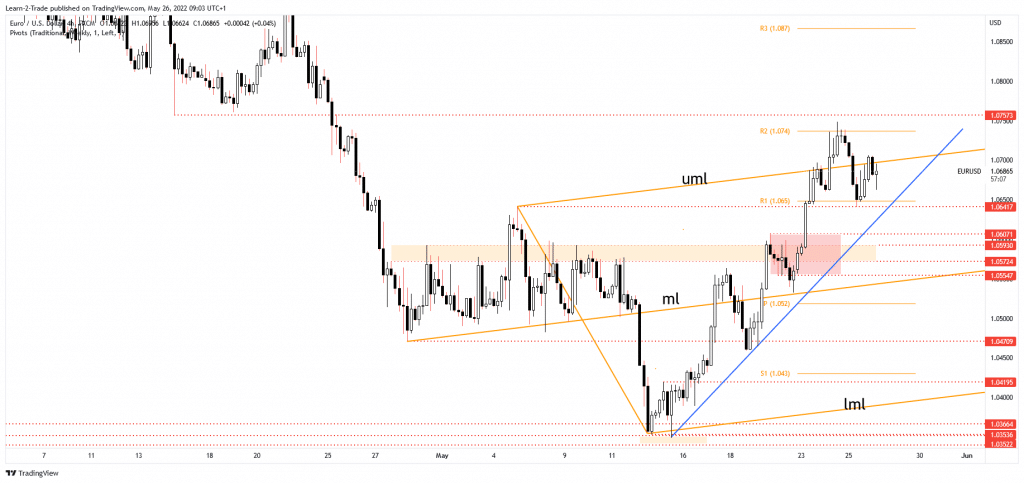

As you can see from the 4-hour chart, the EUR/USD pair found support right on the former high of 1.0641 and on the weekly R1 of 1.0650. In the short term, the bias is bullish as long as it stays above the uptrend line.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

Now, it has retested the ascending pitchfork’s upper median line (UML) and the 1.0700 psychological level. These are seen as immediate upside obstacles. Taking out these resistance levels may signal further growth. Actually, only a new higher high, a valid breakout above the 1.0757 key resistance could really activate a larger swing higher.

On the other hand, a valid breakdown below the uptrend line could signal that the leg higher ended and that the rate could develop a new sell-off.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money